Blockstream, a top-tier Bitcoin infrastructure firm, has joined forces with STOKR, a trailblazing digital platform for alternative assets based in Luxembourg. Their collaboration has birthed a new investment offering: The Blockstream ASIC (BASIC) Note.

During the latest bitcoin bull market, prices for bitcoin mining machines, otherwise known as ASICs, witnessed a significant surge. This was followed by a major crash, bottoming in December 2022. The value of ASICs tend to have a pattern: They seem to be undervalued during bear markets, while enjoying outperformance during bull runs. This pattern points to a potential profit shift when measured in bitcoin terms.

This new BASIC investment vehicle is seeking to raise $5 million through the sale of its Series 1 BASIC Notes, priced at $115,000 each. The aim? To acquire ASICs in bulk now, store them and then strategically sell them as the market rebounds, especially keeping the upcoming Bitcoin halving event in April-May 2024 in mind.

Considering the resounding success of the Blockstream Mining Note (BMN), which attracted $50 million from global investors through eight rounds between 2021 and 2022, the BASIC Note’s introduction has already garnered considerable market attention. This investment tool is designed to focus on a bitcoin-centric return strategy and fees are only charged when the product outperforms bitcoin.

Interestingly, the investment product will be pitched as an EU-compliant digital security on the Liquid Network.

The rationale behind the BASIC structure includes:

- Market Forecasting: There’s a predicted surge in the bitcoin price, potentially from late 2023 to 2024. This is expected to couple with an increase in ASIC prices.

- Supply/Demand Dynamics: With the imminent Bitcoin “halving” event on the horizon, miners are likely to update their machinery, pushing demand for modern, energy-efficient devices.

- Liquidity and Access: As capital gradually becomes more available, miners will likely have better access to resources in order to procure ASICs.

Blockstream CEO and Co-founder Dr. Adam Back remarked, “Since our founding in 2014, Blockstream has continuously been a leader in Bitcoin mining, from providing world-class mining infrastructure to delivering innovative investment vehicles like the Blockstream Mining Note. The BASIC Note arrives at an opportune time in the market, presenting a unique and carefully timed investment opportunity for any bitcoin-focused portfolio.”

Arnab Naskar, STOKR’s Co-founder, envisions digital securities transforming capital markets and believes that products like the BASIC Note will play a significant role in bridging traditional finance with Bitcoin.

It’s worth noting that the BASIC Note won’t be accessible in every jurisdiction. Each Series will feature its own distinct set of BASIC Notes, issued via the Liquid Network.

]]>

Riot Platforms, the largest public U.S. Bitcoin mining company in terms of developed capacity, has made a groundbreaking announcement regarding a partnership with Bitcoin ASIC manufacturer, MicroBT. The two major bitcoin companies will bring the production of MicroBT’s ASICs to America. The collaboration aims to secure miners for Riot’s Corsicana facility, significantly boosting the company’s mining capabilities. According to a press release shared with Bitcoin Magazine, this development comes as Riot’s Corsicana facility is set to increase the company’s developed capacity to 1.6 GW.

“This agreement directly repudiates every major criticism of our industry,” the press release stated. “For those concerned about our energy consumption, these machines will be more efficient than ever … For those who say Bitcoin mining data centers do not actually create jobs, we are helping to create hundreds of jobs, between the MicroBT manufacturing facility in Pennsylvania, and our state of the art data center coming to Corsicana, Texas.”

One of the key highlights of this partnership is the expected increase in Riot’s self-mining hash rate capacity. The press release states that by mid-2024, upon the full installation of the machines from this order, Riot’s self-mining hash rate capacity is projected to surge by approximately 61% to over 20 EH/s. This significant boost in capacity further establishes Riot’s position as a leading player in the Bitcoin mining industry.

Moreover, this partnership between Riot and MicroBT also marks a pivotal moment for the industry. Bitcoin miner manufacturing has traditionally been concentrated in Asia, but this new partnership with Riot strengthens the domestic supply chain in the United States. It expands the options available to Bitcoin miners, offering them a robust selection of machines.

Importantly, the collaboration between Riot and MicroBT will not only have a positive impact on the industry but also on local job creation. The machines will be manufactured by MicroBT at a new facility in the United States, generating employment opportunities in the local area.

Riot’s partnership with MicroBT signifies a major milestone within the Bitcoin mining industry. With the increased hash rate, domestic manufacturing and job creation, this collaboration is set to shape the future of Bitcoin mining in the United States and contribute to the growth of the industry as a whole.

]]>

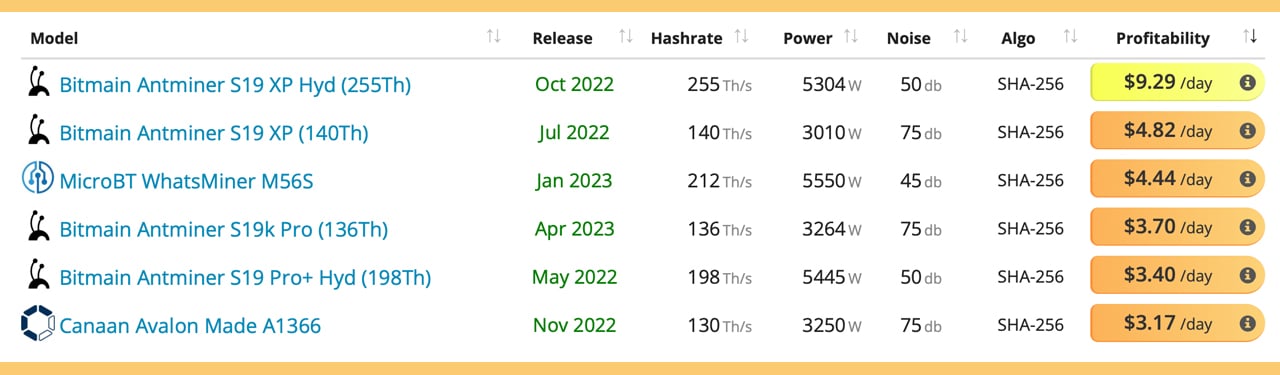

According to statistics from mid-May 2023, 18 different application-specific integrated circuit (ASIC) bitcoin mining devices are profitable using today’s bitcoin exchange rates. Additionally, the top bitcoin mining machines today are made by three prominent ASIC manufacturers, as fabrication competition these days is limited.

18 ASICs Profit With Electricity Costs at $0.12 per kWh and Today’s Bitcoin Exchange Rates

The average hashrate of the Bitcoin blockchain over the last 2,016 blocks stands at approximately 353.9 exahash per second (EH/s) at present. In an impressive feat this month, on May 2, 2023, at block height 787,895, the network reached an unprecedented peak of 491.15 EH/s. Meanwhile, the price of bitcoin (BTC) has been steadily hovering slightly below the $27K mark. Real-time mining rig data gathered from asicminervalue.com reveals that there are 18 profitable SHA-256 ASIC miners in operation using current BTC exchange rates.

Given the present value of BTC and the rapid surge in hashrate, one might expect a multitude of ASIC manufacturers to be actively crafting advanced mining rigs in 2023. Surprisingly, however, the landscape is dominated by just three prominent ASIC fabricators exclusively focused on designing mining rigs for bitcoin extraction: Bitmain, Microbt, and Canaan. All 18 of the leading ASIC bitcoin miners, compatible with SHA-256 and currently generating profits, originate from these three manufacturers.

The Top 6 Most Profitable ASIC Bitcoin Miners on the Market in 2023

The top bitcoin mining rig is the Bitmain Antminer S19 XP Hydro, boasting a hashrate of 255 terahash per second (TH/s). With its establishment dating back to 2013, Bitmain has cemented its presence in the industry over the years, manufacturing 10 out of today’s top 18 ASIC miners. Taking into account current BTC exchange rates, data reveals that the S19 XP Hydro yields an estimated daily profit of approximately $9.29, factoring in an electricity cost of $0.12 per kilowatt hour (kWh).

In close pursuit, the Antminer S19 XP, producing 140 TH/s, firmly secures its position as the second most lucrative ASIC rig. The S19 XP rakes in an estimated daily profit of $4.82 while upholding the same electricity costs. Trailing closely behind is Microbt’s Whatsminer M56S, commanding 212 TH/s and claiming the spot as the third most profitable bitcoin miner in the current market. Projections suggest that the M56S yields a daily profit of $4.44.

Following suit, the Antminer S19k Pro produces a hashrate of 136 TH/s, while the Antminer S19 Pro+ Hydro clocks in at 198 TH/s. These two miners are estimated to generate a daily profit ranging from $3.40 to $3.70. The fifth most profitable ASIC mining rig is Canaan’s Avalon A1366 which produces 130 TH/s. At $0.12 per kWh, the Avalon A1366 gets an estimated $3.17 per day in profit.

With electricity costs set at $0.12 per kilowatt hour (kWh) and considering the prevailing BTC prices, a total of 18 mining devices prove to be profitable. However, if the electricity rate drops below $0.12 per kWh, a broader range of machines with lower terahash outputs become financially viable.

While the global average electricity rate hovers around $0.14 per kWh, there’s a decent amount of countries, including Iran, Cambodia, Afghanistan, Belarus, Cape Verde, Brazil, Central African Republic, Bhutan, and Azerbaijan, among others, where electricity rates range from $0.01 to $0.05 per kWh.

What are your thoughts on the current landscape of Bitcoin mining and the dominance of a few major manufacturers? Share your insights and opinions in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

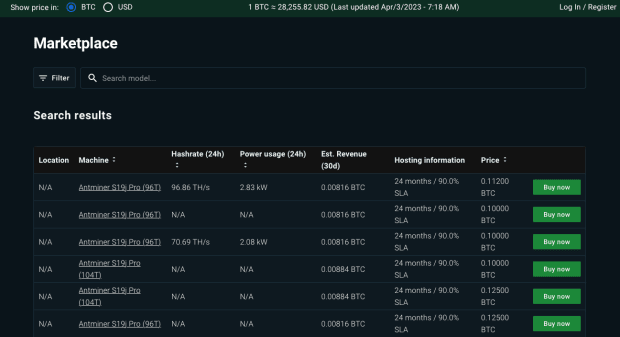

Blockware Solutions, a professional Bitcoin mining services company, has announced the public launch of its Blockware Marketplace. The new platform has been operating in stealth mode with only existing Blockware clients according to a press release sent to Bitcoin Magazine, and the total trading volume has already reached about $100,000, mostly within the last two weeks.

According to the announcement, the Blockware Marketplace is a product that brings transparency and “turnkey mining” to a whole new level by allowing anyone to buy an ASIC using either on-chain bitcoin or Lightning. Users can also see its historical and live hash rate before purchasing. Customers will be able to start earning bitcoin mining rewards in minutes, making it easier and more accessible for people to participate in the mining industry.

“We think this has the potential to transform the mining industry as now anyone can buy an ASIC (On-chain or Lightning), see its historical and live hashrate before purchasing, and be earning BTC mining rewards in minutes,” said Joe Burnett, head analyst at Blockware.

The Blockware Marketplace is designed to simplify the process of buying and selling ASICs, as the screenshot above shows. The simple UI shows the stats of the miners, hosting information and price in BTC. An account sign up is required to utilize the marketplace, which is open to the public starting today.

]]>

Compass Mining, a bitcoin mining firm, published a blog post stating that Bitmain, the company behind the application-specific integrated circuit (ASIC) mining rig, has made changes to its design. The post advised miners to be aware of the changes as Compass Mining identified “three issues” with two different Antminer S19 series mining devices.

Bitcoin Miner Compass Mining Identifies 3 Issues with Antminer S19 Series

Compass Mining, a bitcoin mining company, posted a blog post titled “Bitmain Changed Its ASIC Design. Miners Need to Be Ready,” highlighting changes in Bitmain’s ASIC design. Compass believes bitcoin mining facility operators should be aware of the changes, which could cause issues. For example, the firm identified three problems with the Antminer S19, producing 90 terahash per second (TH/s), and the S19 XP, offering 140 TH/s.

William Foxley of Compass Mining explains that the new machines lack a peripheral interface controller (PIC) on the ASICs, making it harder to control individual hashboards compared to those with a PIC. The devices use aluminum plating on the side of the mining rig, which Foxley believes may contribute to overheating issues. Additionally, there is a “consolidation of all components onto one side of the board, causing an increased chance of hashboard errors.”

Foxley explains that without a PIC, units cannot underhash on “one or two boards,” and hashboards made with aluminum plates may fail more frequently in hot climates like Texas than those made with printed circuit boards (PCBs). Additionally, Compass Mining believes non-Bitmain repair shops may face difficulty replacing damaged chips. The operations team discovered these issues within the last six months, and they “significantly affect a unit’s performance.”

In conclusion, Foxley notes in the blog post that third-party firmware could address the PIC issue and enable a miner to run on one or two boards. Third-party firmware can also lower specific variables to keep the ASIC mining rig cooler. The post suggests selecting the best environmental conditions as another solution. However, regarding the aluminum plating, Compass Mining views it as a net negative.

“We view the design decision to swap to aluminum-plating on hashboards as a net negative–one that will increase ASIC failure and underhashing while increasing service and maintenance costs,” Compass’s blog post concludes. “Paired with the lack of a PIC and increased difficulty of swapping out bad chips, we encourage miners to double down on their repair game as they onboard next generation units into their fleets.”

What do you think of Bitmain’s decision to change its ASIC design? Share your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Compass Mining

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

According to a new filing with the U.S. Securities and Exchange Commission on Mar. 7, Canaan, a Chinese Bitcoin (BTC) miner and manufacturer of application-specific integrated circuit (ASIC) mining machines, reported that its revenue decreased by 82.1% Y/Y to $56.8 million in Q4 2022. During the quarter, Canaan sold 1.9 million terahash per second worth of computing power for Bitcoin mining, not accounting for lower ASIC prices, representing a 75.8% decline from Q4 2021.

At the same time, Canaan’s mining revenue improved 368.2% year over year to $10.46 million. As told by Nangeng Zhang, chairman and CEO of Canaan:

“To mitigate demand risks during the market downturn, we have been diligently improving and developing our mining business. Our efforts yielded more progress in early 2023 with 3.8 EH/s hash rate installed for mining as of the end of February. Accordingly, we have made decisive investments in bolstering our production capacity and expanding our mining operations to more varied geographic regions that offer advantageous conditions.”

Despite the segment’s success, however, Canaan’s net income swung to a $63.6 million loss in Q4 2022 compared to a profit of $182.0 million in Q4 2021. As told by Jin Cheng, Chief financial officer of Canaan, the loss was due to inventory write-downs and research expenses related to its new fleet of ASICs.

“Considering very soft market demand and low selling price, we incurred an additional inventory write-down of RMB205.3 million, which also dampened our gross margin. In conjunction with one-time higher research and development expenses relating to the tape-out for our A13 series, our bottom line suffered losses during the quarter.”

For the full year, the firm’s revenue decreased by 13.8% to $634.9 million, mainly due to better industry conditions in Q1 and Q2 2022. The firm currently has $706 million in total assets compared to $67 million in total liabilities.

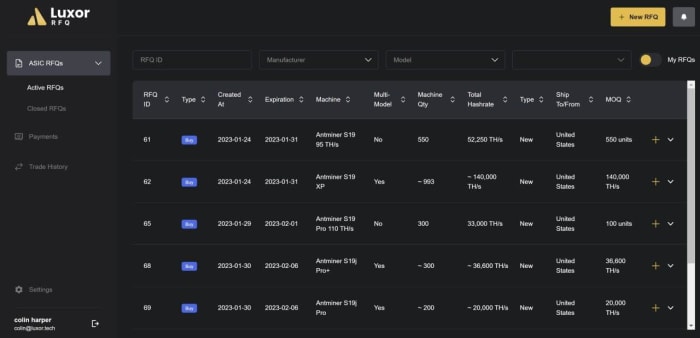

Luxor has launched the first ever ASIC RFQ platform with the goal of maximized market transparency and access.

Luxor Technologies, a full-stack Bitcoin mining software and services company, has launched the first request-for-quote (RFQ) platform for buying and selling Bitcoin mining hardware.

The press release sent to Bitcoin Magazine describes what an RFQ platform is, saying “An RFQ is a marketplace where users can create orders (requests) for specific items. Luxor’s double-sided RFQ allows both buyers and sellers to create requests for Bitcoin mining ASICs.”

The idea is that it will create a more liquid and easy to use marketplace for ASICs — specialized machines specifically built to mine bitcoin. According to the release, “Using an open-bid system, ASIC traders can place requests and negotiate prices directly, improving price discovery and increasing liquidity in the secondary market.”

Prior to this market, ASIC traders have struggled with a fragmented and opaque over-the-counter market. This system will theoretically improve the transparency of the market, while allowing for easier access and more precise market pricing. ASIC brokers will form the backbone of market makers on the platform, and they will be able to leverage it to increase their deal flow and facilitate more transactions.

“We built Luxor RFQ because we saw the need for a unified platform for trading Bitcoin mining hardware,” Luxor Operations Manager Lauren Lin commented. “Before, buyers and sellers relied on a patchwork of venues to buy and sell mining hardware. Now, they can observe offers, listings, and settlement prices all in one place, which improves pricing transparency and expedites the mining hardware procurement process.”

The RFQ platform will offer major flexibility to buyers, allowing them to specify orders by quantity, condition, model type, location and more. In addition to this, sellers will be able to mix-and-match models from different manufacturers in their orders. The platform’s auction-style bidding process will benefit sellers and brokers.

Luxor states that it is committed to transparency, saying that “Platform fees are transparent and volume based so that market makers can transact in a larger, more profitable way.”.

Bitcoiners interested in learning more about Luxor’s RFQ, can visit the RFQ website or contact the company at: [email protected].

]]>