Crypto-focused investment firm Pantera Capital says bitcoin has seen its lows and “we’re in the next bull market cycle.” Dan Morehead, the firm’s founder and managing partner, noted: “Over the long-term, bitcoin price has been in a secular uptrend of 2.3x annually over the past twelve years, on average.”

Pantera Capital on the Next Bull Market

Pantera Capital published its February Blockchain Letter last week. The letter, titled “The Seventh Bull Cycle,” is authored by founder and managing partner Dan Morehead and investment associates Ryan Barney and Sehaj Singh. Pantera Capital is an investment firm that specializes in cryptocurrencies, digital assets, and blockchain technology.

Referencing his analysis of bitcoin price cycles in the letter, Morehead tweeted Thursday:

I believe that blockchain assets (using bitcoin as a proxy) have seen the lows and that we’re in the next bull market cycle — regardless of what happens in the interest-rate-sensitive asset classes.

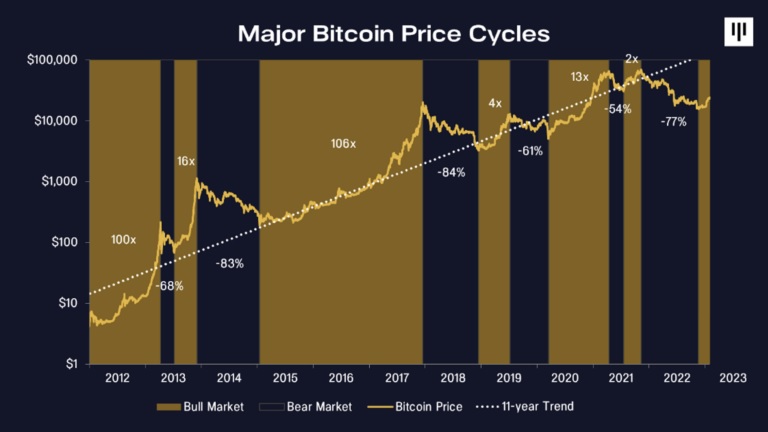

“That would be the seventh bull cycle, after six bear cycles,” he noted. Morehead explained in the letter that Pantera has been through 10 years of bitcoin cycles and he has traded through 35 years of similar cycles.

The Pantera Capital founder pointed out that the BTC price decline from November 2021 to November 2022 was “the median of the typical cycle.” He added: “This is the only bear market to more than completely wipe out the previous bull market. In this case, giving back 136% of the previous rally.”

“The median downdraft has been 307 days and the previous bear market was 376. The median drawdown has been a -73% downdraft and the latest bear market ended at -77%,” Morehead continued. “I think we’re done with that and beginning to grind higher.”

Morehead further noted:

Over the long-term, bitcoin price has been in a secular uptrend of 2.3x annually over the past twelve years, on average.

Do you agree with Pantera Capital founder Dan Morehead that we are already in a bull market cycle? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.