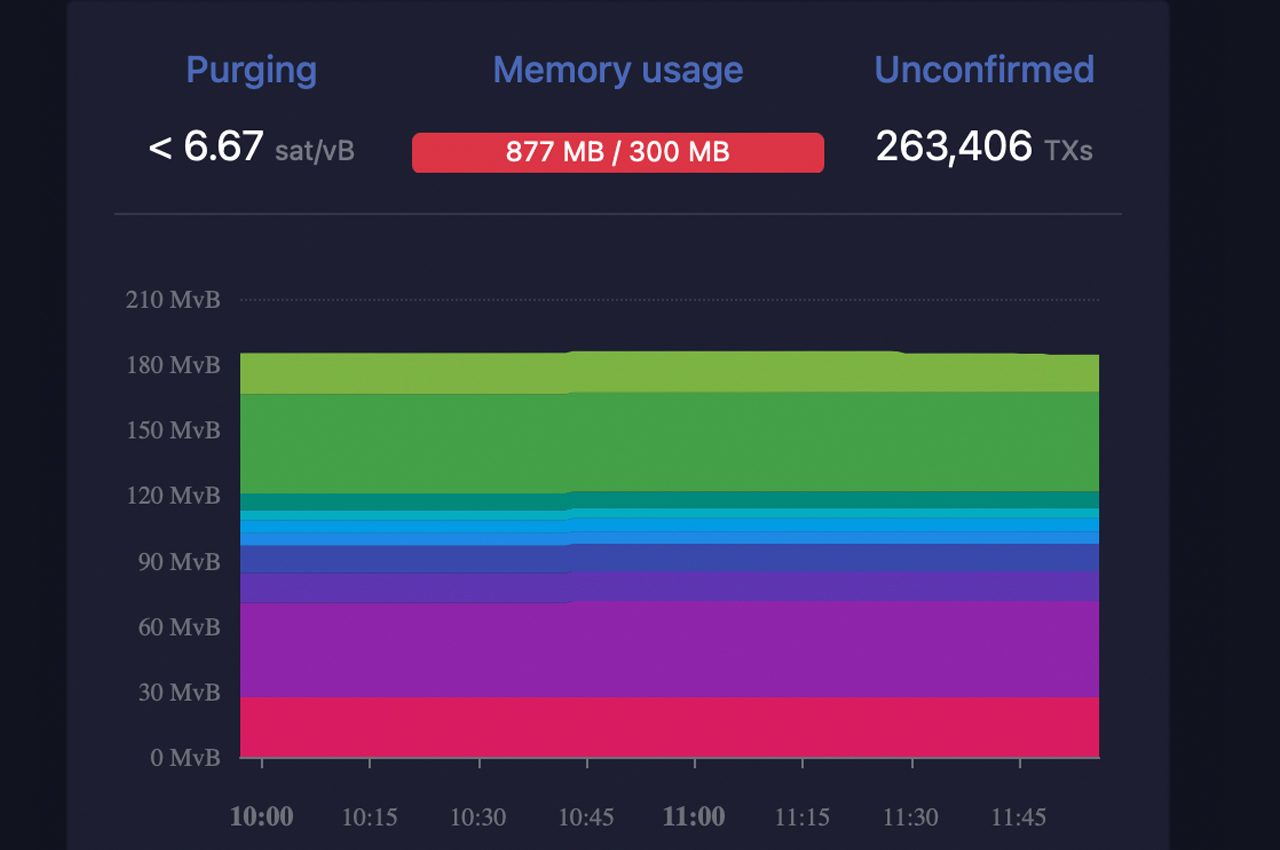

In the past week, the Bitcoin network has made progress in resolving its congestion issues. On May 7, 2023, the number of unconfirmed transactions reached an all-time high of over 500,000 transfers, causing a major backlog. However, as of today, that number has been reduced to 263,406. Currently, 184 blocks need to be cleared to process the majority of transactions that are still stuck in the network’s mempool.

Congestion Woes Ease on Bitcoin Network

The long queue of transactions is finally starting to subside as bitcoin miners have started catching up with some of the backlog. As we reported three days ago, Bitcoin.com News noted the beginning of the congestion-clearing process, with unconfirmed transactions dropping from over 500,000 on May 7 to just above 300,000 on Thursday, May 11.

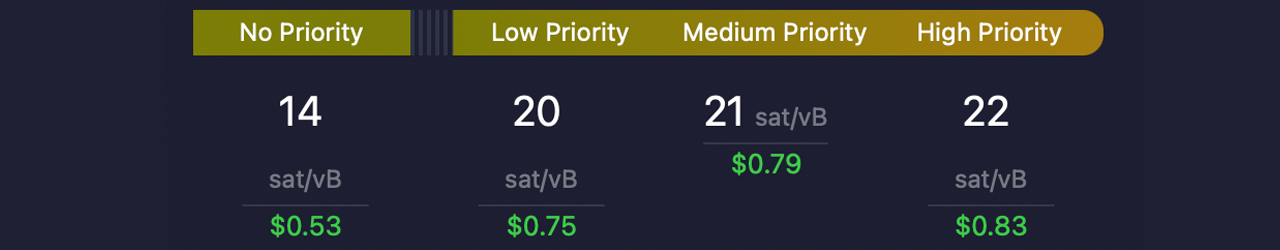

According to mempool.io statistics, high-priority transactions were priced at $3 per transfer, while low-priority transactions cost $2.23 per transfer at that time. Current statistics on May 14 show that onchain fees have significantly subsided on the Bitcoin blockchain over the past three days. Just a few days ago, a high-priority transaction would have cost $3, but today, that fee has dropped to $0.83.

A medium-priority transfer is now priced at $0.79, while a low-priority transaction can cost around $0.75. This is a significant improvement, with high-priority onchain fees sliding by 72.33% over the past 72 hours. Additionally, the number of unconfirmed transactions stuck in the queue has reduced to 263,406, which is just above half of what it held on May 7.

Lightning Network Capacity and Channels Drop

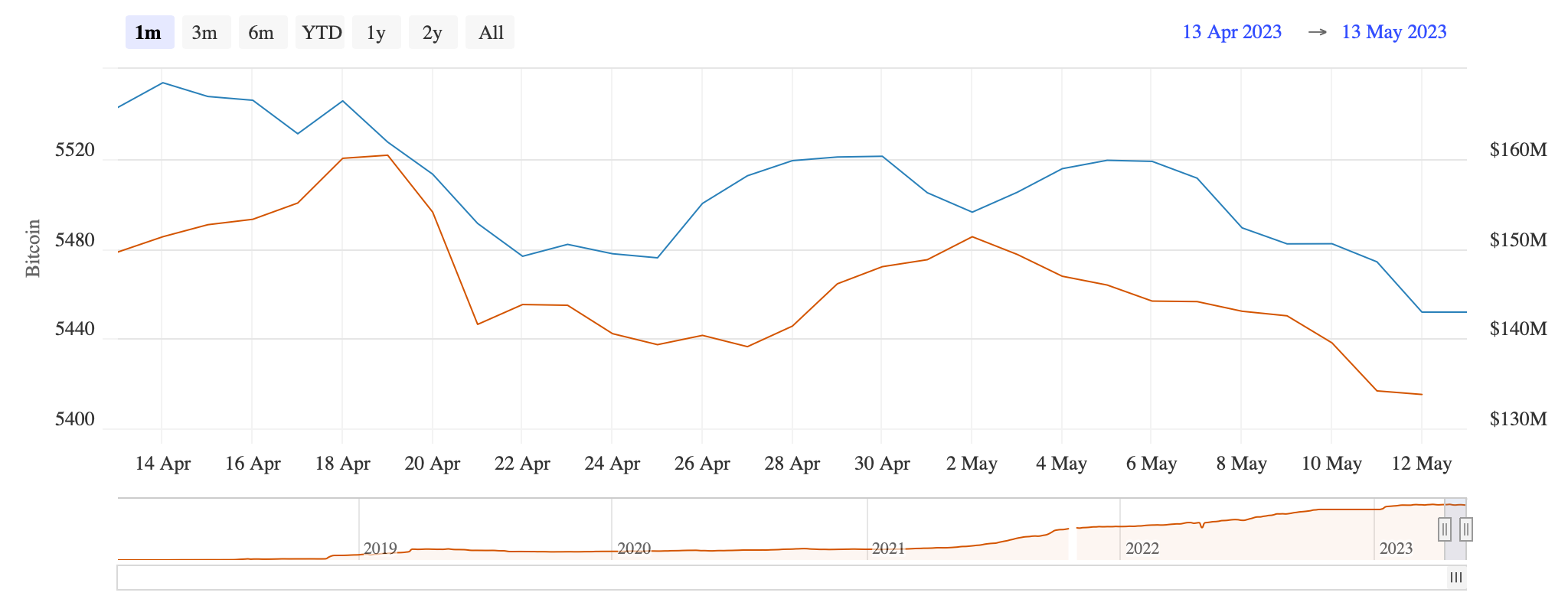

On May 9, the number of transactions was around 413,420, which means that 36.28% of the backlog has been cleared in the past five days. While fees skyrocketed to roughly $30 per transaction on May 7 and have been quite volatile lately, the Lightning Network’s capacity did not improve. In fact, the number of BTC locked into the Lightning Network dropped from 5,463 BTC on May 5 to today’s capacity of 5,415 BTC on May 14.

The dip indicates that roughly $1.28 million in value left the Lightning Network amid the transaction backlog chaos. On May 8, the Lightning Network boasted 73,352 unique channels. However, that number has since decreased to the current 71,286 unique channels. According to mempool.space’s Lightning Network metrics, roughly 5,057 BTC in capacity is on clearnet, while 253 BTC of capacity is using Tor. The remaining Lightning Network capacity is identified as “other.”

What are your thoughts on the recent developments in the Bitcoin network and the Lightning Network’s capacity? Share your insights in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.