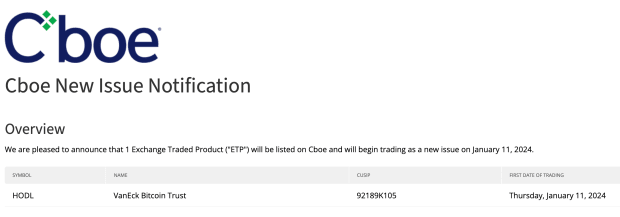

The Chicago Board Options Exchange (CBOE) has declared on their website that VanEck, Fidelity, and ARK 21Shares Spot Bitcoin Exchange-Traded Funds (ETFs) will officially commence trading starting tomorrow, pending regulatory approval and effectiveness.

The CBOE’s announcement signifies a major milestone in the quest for regulated and direct exposure to Bitcoin through ETFs, allowing both institutional and retail investors a pathway to Bitcoin exposure.

This development follows meticulous regulatory evaluations and market preparations, positioning the Spot Bitcoin ETFs for an eagerly awaited debut on the trading floor. The CBOE’s confirmation reinforces the growing acceptance and recognition of Bitcoin as a legitimate and regulated investment asset class.

The imminent commencement of trading for Spot Bitcoin ETFs underlines a historic moment poised to reshape the investment landscape, providing broader access to Bitcoin within traditional financial markets. However it is important to note, at the time of writing, the U.S. Securities and Exchange Commission (SEC) has yet to officially approve the ETFs for trading, which approvals are expected later today.