Whether you’re young, mid-career, or playing the back nine, Roth IRAs can be an important tool for your financial goals. Four case studies below will illustrate how by combining Roth IRAs with bitcoin, you can save for retirement, optimize for your personal tax situation during retirement, and leave your bitcoin for the next generation.

These are hypothetical case studies based on our experiences, not real people. They’re intended to help you better understand how bitcoin Roth IRAs can fit into many types of retirement plans. Hence, they’re for educational purposes—you should discuss all personal situations with a financial, tax, or legal expert.

- Sally the super stacker: Saving for retirement

- Rod is retirement ready: Entering retirement

- Larry wants to leave a legacy: Inheritance

- “Why Would I?” Wayne: Reasons not to Roth

1. Sally the super stacker: Saving for retirement

Sally is in her early 30s and has fallen down the bitcoin rabbit hole. Sally views bitcoin as the best savings technology given today’s current macroeconomic backdrop and bitcoin’s fixed supply of 21 million and is committed to a disciplined accumulation strategy.

She’s looking for a way to save her hard-earned money without suffering debasement over time. Ultimately, she would like to use her savings for major goals: a dream vacation, a house, starting a family, and maybe retiring someday. But retirement is a distant goal, and she thinks the United States could go through some significant changes before she’s ready to settle down.

Why would she even bother with the fiat-based American retirement system? The rules, limits, penalties, and potential changes aren’t worth it. Just keep your head down and stack sats, right? Not so fast, Sally.

Importance of tax-free growth

Like most bitcoiners, Sally is stacking bitcoin with money that has already been taxed. Her payroll taxes are withheld on payday, and she is paid the remaining U.S. dollars into her bank account. She then sends money to an exchange and purchases bitcoin. This is the typical way most people stack sats—post-tax.

However, just because the bitcoin is purchased post-tax does not mean it won’t be taxed again. Non-retirement bitcoin earnings are taxed as a capital gain when sold. Over her years of stacking, she will need to keep track of her cost basis and deduct that amount from the gross proceeds when selling.

It’s a simple formula: (final trade) minus (what you paid) equals (what you made). What you make is taxed as capital gains.

Enter the Roth IRA

This is where a Roth IRA savings vehicle adds value. If Sally were to contribute to a bitcoin Roth IRA, contributions would still be made post-tax—same as before. But the key difference is that qualified Roth IRA distributions are tax-free. She only pays tax once, not twice.

The potential implications of tax-free bitcoin are massive. If the dollar value of bitcoin exponentially increases as Sally expects, then reducing her potential tax burden becomes increasingly rewarding.

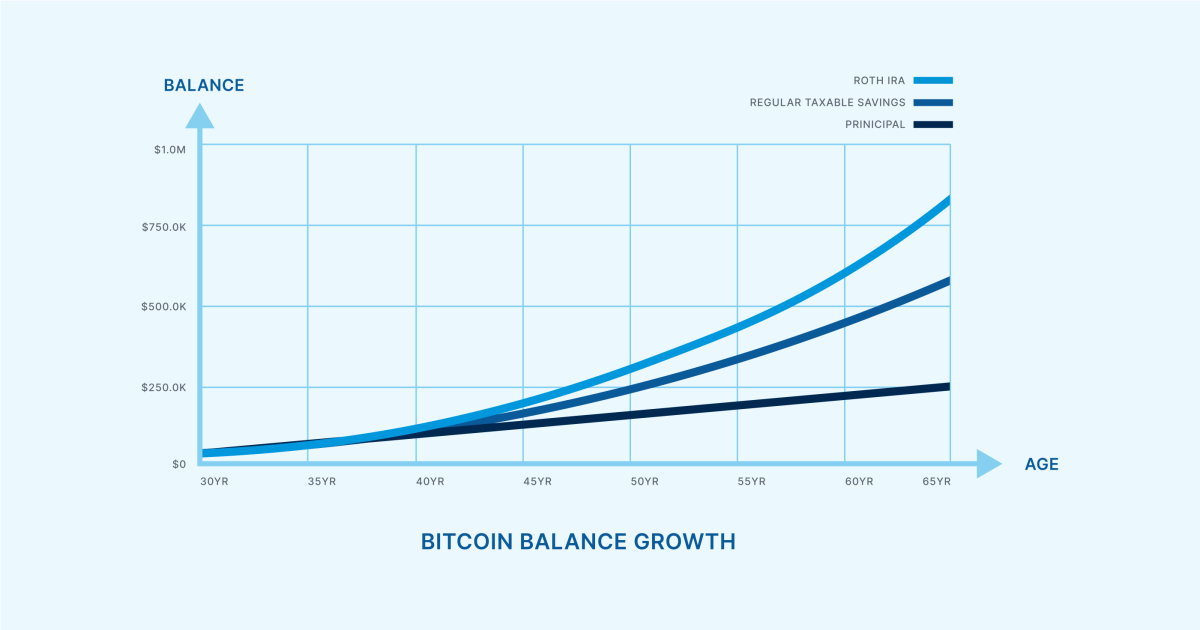

Let’s assume she starts saving $6,000 per year at age 30 until she reaches age 65, and bitcoin grows at 6% annualized (feel free to plug in your own assumptions). At age 65, she will have accumulated $822,330. And if she had to pay an estimated 20% capital gains tax, it would amount to a bill over $117,000.

In this scenario, a Roth IRA saves her more than $117,000. The Roth becomes a vehicle to supercharge future purchasing power without changing her current taxation. Not having to pay tax on future gains has an exponential impact over time.

Not just retirement: Withdrawing contributions

Four years into maximizing her bitcoin Roth IRA contributions, Sally has contributed $24,000 (four years of $6,000 max) and experienced a rapid increase in bitcoin price—a common experience for many bitcoiners. Let’s assume a hypothetical balance of $100,000. To celebrate and reward herself, she has planned a Miami vacation. However, she can’t decide if she should sell her non-retirement bitcoin and pay gains tax or take it from her retirement account and pay penalties.

With penalty-free access to Roth contributions, Sally can take up to $24,000 (her total contributions) out of her Roth without incurring penalty or tax. In this imaginary scenario, let’s say she ends up pulling $10,000 from the Roth for her Miami vacation.

More ways to maximize a Roth

If Sally meets someone in Miami, she could pull $10,000 more from the Roth for an elopement wedding. And the house with the picket fence? The Roth allows for some flexibility in that, too: Roth IRAs allow for up to $10,000 of earnings to be withdrawn penalty-free if used for a first-time home purchase. With $4,000 of contributions left and an additional $10,000 in earnings for the first-time home purchase, Sally could combine forces with her equally-wise new spouse—who was also contributing to a Roth—and compile $24,000 for a down payment.

After the tax- and penalty-free spending spree has subsided, she and her spouse can continue to regularly contribute again, saving for the next big goal, and ultimately for retirement.

Key takeaways

The Roth account has more flexibility than just saving for the classic age 59 ½ retirement scenario. Tax-free growth is a powerful tool to grow wealth over time and should be strongly considered for any retirement plan. You can pull contributions tax- and penalty-free at any time, and earnings are tax-free at retirement age. Certain conditions even allow you to pull earnings from your Roth without a penalty.

2. Rod is retirement ready: Entering retirement

Rod has been diligently preparing for retirement. He’s mentally there, but financially not ready to take the leap. Still, bitcoin has become an increasingly important position in his portfolio. What started as a hedge (1-2%) has become a core component (+10%). He holds some bitcoin directly but has more exposure through bitcoin-adjacent assets (GBTC, MicroStrategy, mining stocks, etc.).

He’s not ready to go all-in on bitcoin because, although he believes in its importance, the volatility conflicts with his desire for financial stability during retirement. He has worked hard to earn his nest egg and would hate for it to disappear—especially to taxes. Within the next 5-10 years, he will transition out of his career and live off his 401k, investment account, real estate equity/income, and bitcoin. Any social security or pension are just a bonus.

Brackets and buckets

Rod needs to dive into his financial situation and see how his tax brackets will look. What will they look like the Monday morning after he retires? What will they look like after the pension or social security start? What about when the 401k required minimum distributions start at age 72? Knowing where the money is coming from, when it occurs, and how it’s taxed are critical components to retiring—and staying retired.

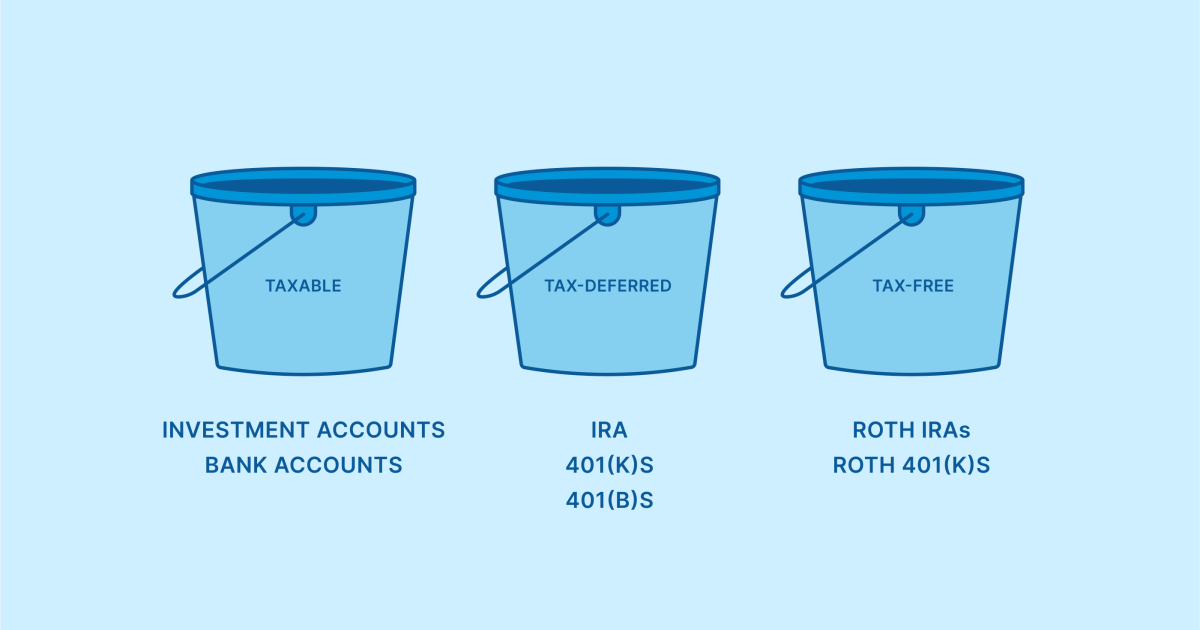

To make a plan, Rod needs to think about each account type as being in a different “tax bucket”. His taxable assets are taxed upon sale, and his tax-deferred accounts are taxed when he takes income from them. The Roth provides another bucket: tax-free income. If Rod were to add a Roth IRA, he could pull from different buckets depending on the plan and the need.

For example, Rod can pull from the Roth in high tax years and keep his bracket from climbing too quickly. He can pull from taxable or Traditional IRAs in low tax years and accelerate that income at a lower marginal rate. More sophisticated strategies could include conversions, delaying income, gifting taxable assets, etc. The key point: Roth allows for diversification in “tax buckets” to optimize your tax bracket in retirement.

When Rod adds this tax-free bucket to his picture, he decides to fill it with high risk/reward assets like bitcoin. If the growth is tax-free, then it makes sense for it to grow as much as possible. He decides to sell his mining stocks, GBTC, and MSTR and convert that cash into a bitcoin IRA (preferably one where he controls access to the keys).

Key takeaways

What did your bracket look like this year? No, not the March Madness one. The un-fun IRS one. All retirees must consider their expected tax bracket throughout retirement, and tax bracket management is a science and an art. Specifics vary from person to person, but the main concept applies: The more diversified your “tax buckets,” the more flexibility and optionality you will have in any tax environment.

3. Larry wants to leave a legacy: Inheritance

Larry has been enjoying his time with his wife and grandchildren. He had a successful career and profitable investments that have sustained his lifestyle through retirement. Now, he thinks much more about the next generation and the challenges and struggles they will face. He wants to protect those he cares about and leave the world a better place.

At first, bitcoin didn’t make sense to him. He thought it was just another get-rich-quick scheme. But given the state of the world today and institutional financial foolishness taking place, he’s now open to seeing its long-term potential. Larry’s main goal is to leave bitcoin for the kids and grandkids. He thinks it could become meaningful for their future when he’s no longer with them.

Inheritance and estate considerations

When Larry sets up a Roth IRA, he does not ever have to take Required Minimum Distributions from that account. He can leave the assets there to grow tax-free for the long term—perfect for bitcoin. Larry can easily add or modify beneficiaries to that IRA at any time, and beneficiaries will receive the Roth income tax-free upon his passing. He can accomplish his goal of passing bitcoin to his loved ones. (Estate taxes may still apply, Roth IRAs only avoid income tax.)

Converting to a Roth IRA

Larry was already retired when the Roth IRA came out in 1997, so he doesn’t have an existing Roth, and you need earned income to contribute. But even though he can’t add money directly to one, he can consider a Roth conversion.

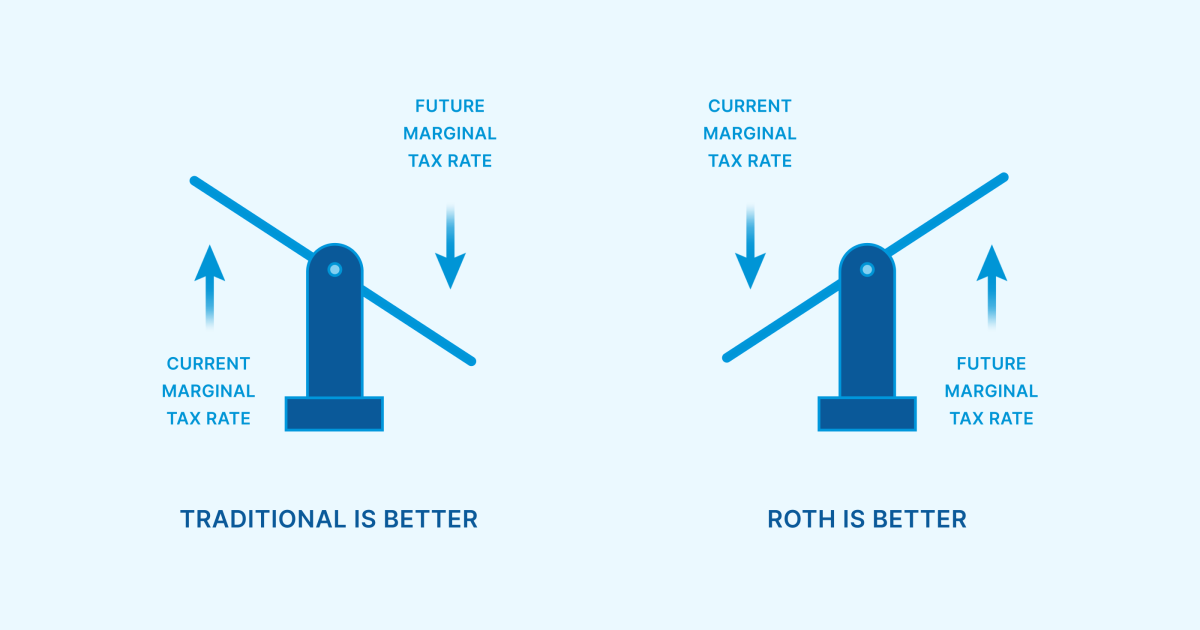

He can take pre-tax 401k/IRA funds and convert them to Roth, allowing him to pay the tax now and turn it into a tax-free vehicle for future generations. As to whether this is a good idea for your beneficiaries, the math is fairly simple: if you expect your tax rate to be lower than your beneficiaries’ tax rate, then the Roth would make more sense.

Key takeaways

Larry has optionality. If the math makes sense, he could turn a portion of his portfolio into a bitcoin Roth IRA and leave the asset for future generations. It’s worth noting that holding your own keys in an Unchained IRA requires that you also do proper inheritance planning.

4. “Why Would I?” Wayne: Reasons not to Roth

Wayne is in his peak earning years and making really good money at his fiat job. He lives a simple life enjoying a lot of time outdoors, and expects not to need much income after he retires. He has many hobbies, one of which is mining bitcoin with a few machines from his home. It’s not a large-scale operation, just a hobby, but he would consider mining bitcoin with his retirement account if that were an option. Ultimately, he plans to leave all assets he owns to charities that he cares about.

Brackets and buckets pt. 2

Revisiting the brackets and buckets discussion from above, Wayne’s current income (high bracket) is much greater than his expected future income needs (low bracket). If he were to convert any of his existing retirement assets to Roth, he would be paying a higher rate than if he had just waited to pull it in retirement. From this perspective, it may be wiser to keep the assets in a Traditional pre-tax account and not convert to Roth.

Death and taxes…

You know the saying: nothing is certain in life but death and taxes. If that’s true, we can certainly add “death taxes” to the list. “Death tax” probably wasn’t too popular in opinion research studies, so “estate tax” is the politically correct term these days. In 2022, the estate tax kicks in around $12 million of net worth ($24 million for married couples). Over time, more and more bitcoiners will need to consider this threshold as it becomes relevant to their situation.

As Wayne considers a Roth IRA, he should note Roth IRAs do not avoid the estate tax, only the income tax. Wayne plans to leave all assets to charity. Assets left to qualified non-profit entities would avoid both estate and income tax. In his case, there is no benefit to the Roth over his current structure from a taxation-at-death standpoint. If it goes to charity, it avoids the death tax—a silver lining to say the least.

Mining in a Roth?

Now, let’s re-introduce Wayne’s bitcoin mining hobby. Mining bitcoin within an IRA is technically possible but highly advised against for the average investor. He should be aware of the tax nightmare often involved and consult a tax advisor regarding UBIT (Unrelated Business Income Tax) within IRA accounts. Additionally, if Wayne wants to hold his mined bitcoin without revealing personal information to a financial institution, Roth IRAs simply aren’t an option.

Key takeaways

When considering a financial strategy, no single tool works for every individual’s situation. Factors such as tax bracket, net worth, and charitable intent are all relevant considerations when evaluating a Roth IRA. Mining doesn’t tend to be well-suited for bitcoin IRAs because of UBIT. Due to these factors, a Roth IRA may not be the right route for Wayne.

Wrapping up

Hopefully, you’ve seen how versatile, flexible, and impactful the Roth IRA vehicle can be when combined with the best savings technology ever discovered: bitcoin. You’ve seen circumstances that may positively and negatively affect the suitability of a bitcoin Roth IRA for your financial picture.

When considering bitcoin in a Roth IRA, you should always consider who is controlling the keys. There are tangible differences between the many approaches to bitcoin IRAs, and there’s no reason to let an exchange hack or mistake jeopardize your wealth. The Unchained IRA allows you to secure your financial future by holding your own private keys to your bitcoin.

Whether you’re planning for retirement, entering retirement, or planning your inheritance, the Unchained IRA team can help. To learn more, sign up for an upcoming Retirement and Inheritance webinar or enter your email below to sign up for our newsletter.

This article is provided for educational purposes only, and cannot be relied upon as tax or investment advice. Unchained makes no representations regarding the tax consequences or investment suitability of any structure described herein, and all such questions should be directed to a tax or financial advisor of your choice. Jessy Gilger was an Unchained employee at the time this post was written, but he now works for Unchained’s affiliate company, Sound Advisory.

Originally published on Unchained.com.

Unchained Capital is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.