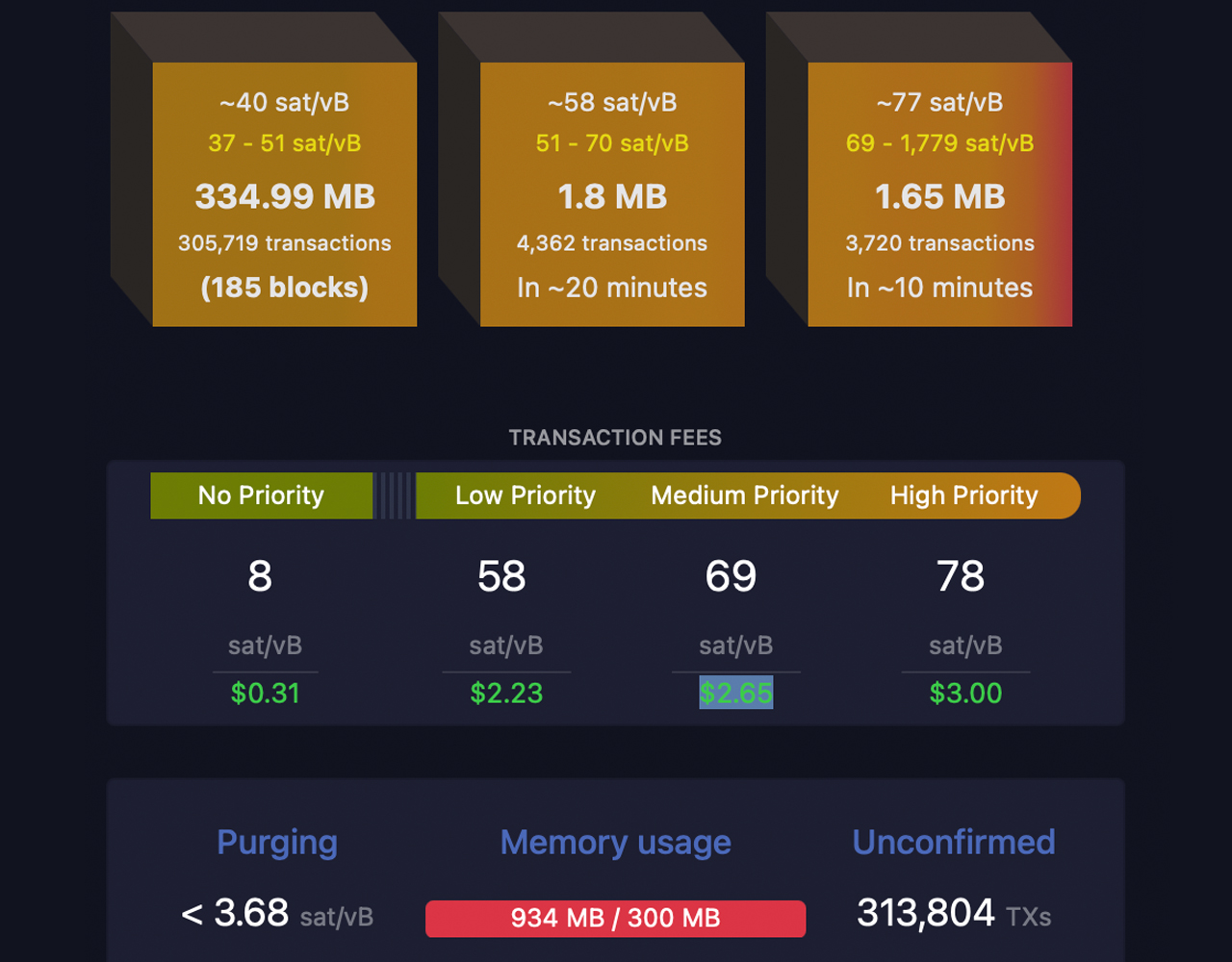

On May 7, 2023, the Bitcoin network was plagued with an overwhelming 500,000 unconfirmed transactions, causing a major bottleneck in the system. However, the good news is that the congestion has been clearing, resulting in a significant reduction in onchain fees, which have now dropped below $5. As of now, there are only slightly over 300,000 unconfirmed transactions awaiting confirmation, and 185 blocks need to be mined to clear the backlog.

Bitcoin Backlog Begins to Gradually Subside

Bitcoin has been the talk of the town lately, as it grapples with the challenge of meeting the demand for block space. Just four days ago, the mempool, which is the queue of unconfirmed bitcoin transactions, hit an all-time high, with over 500,000 unconfirmed transfers waiting to be processed.

This surge in demand can be attributed to the recent craze for Ordinal inscription, as well as the emergence of the BRC20 token economy. As of 7:00 a.m. Eastern Time on May 11, 2023, there are just over 300,000 unconfirmed transactions waiting for confirmation. To clear the current transaction queue, approximately 185 blocks need to be mined.

The good news is that the backlog is gradually clearing, resulting in a significant drop in onchain fees. Just a few days ago, on May 8, the average transaction fee skyrocketed to $31 per transfer. However, as of today, a high-priority transaction at 7:00 a.m. (ET) was a mere $3.00.

The drop from $31 to $3 per transaction represents a reduction of over 90%. In addition, recent statistics reveal that a low-priority transaction costs just $2.23, while a medium-priority transfer is priced at $2.65 per transaction. As of now, the block times have been averaging below the ten-minute mark, with an average of eight minutes and 28 seconds and nine minutes and 57 seconds.

The global hashrate is holding steady at 342 exahash per second (EH/s), and current estimates suggest that the difficulty may increase on May 18, in seven days. The projected difficulty rise is expected to be around 0.1% to 1.94%.

What are your thoughts on the recent developments in the Bitcoin network? Share your insights and opinions in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.