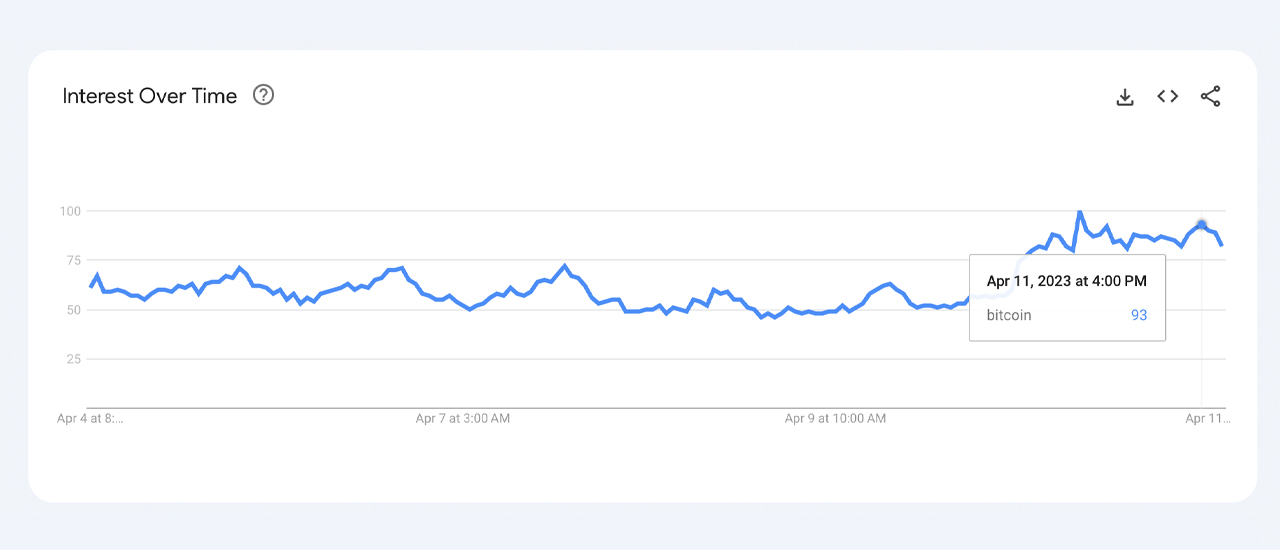

According to worldwide data from Google Trends, the search term “bitcoin” has reached a score of 93 out of 100 in the last seven days. Additionally, the price of bitcoin rose above the $30,000 range for the first time in ten months, or since June 2022.

Bitcoin Search Interest Rises as Leading Crypto Asset Taps $30K

On Tuesday, April 11, 2023, bitcoin’s price rose above the $30,000 mark for the first time since June 8, 2022. According to statistics from coinmarketcap.com, BTC’s dominance is currently over 47%, the highest it’s been in two years. Presently, the hashtags #bitcoin, #ETH, and #cryptocurrency are trending on Twitter, and there are currently more than 88,000 tweets with the #cryptocurrency hashtag. At 4:00 p.m. Eastern Time on Tuesday, the search term bitcoin reached a score of 93 out of 100 on Google Trends (GT).

A GT score of 100 denotes the zenith of a search term’s popularity in the selected region and time period. It also means that more people are searching for the term than at any other time in the past. On the other hand, a score of zero conveys insufficient data to measure the search term’s prevalence. Google Trends data, in terms of search history, dates back to 2004 and the search term bitcoin scored a 2 in June 2011 for the first time.

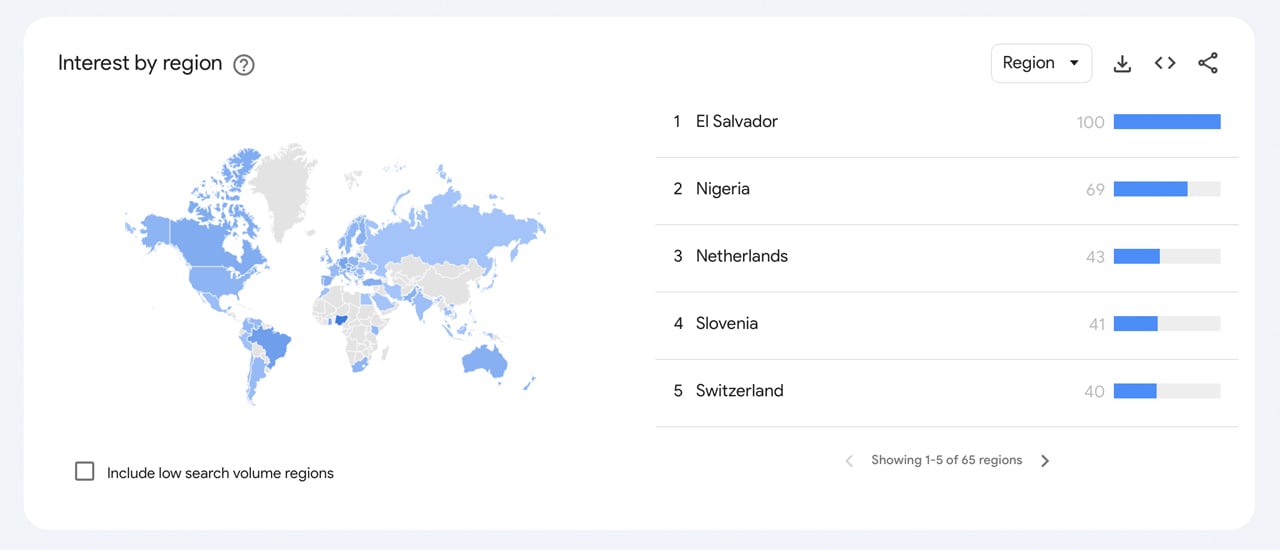

Furthermore, the search volume for bitcoin has increased in the last 24 hours. Over the last 30 days, the search term has a score of 64 out of 100. On Tuesday, the score for bitcoin-related searches for news was 54 out of 100. However, on April 10, 2023, the score for bitcoin news jumped to 100. On Tuesday, a significant amount of worldwide interest in bitcoin search queries was related to El Salvador.

El Salvador is followed by regions such as Nigeria, the Netherlands, Slovenia, and Switzerland in terms of bitcoin search interest. On Tuesday, some of the vertical trends or related queries included Bitfinex being granted a license in El Salvador to issue bitcoin bonds. Other stories related to bitcoin that pushed it to the top of searches included the recent discovery of the Bitcoin white paper on macOS devices. Related topics associated with the search term bitcoin include the white paper, Microstrategy, and the name Nakamoto.

Although bitcoin has risen in popularity this week, according to GT data, the search term has not yet reached the all-time high of 100 that it reached in December 2017. During the 2021 bull run, when bitcoin surpassed its 2017 price high, the search term for bitcoin reached a score of 65. As of March 2023, GT data shows that the score for bitcoin search interest is 23 out of 100. This score is higher than the low of 17 out of 100 that the search term bitcoin received in December 2022.

What do you think is driving the surge in bitcoin search interest, and do you believe this upward trend will continue? Share your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.