This is an opinion editorial by Logan Chipkin, a professional writer who creates educational content about Bitcoin and other topics.

In “The Fiat Standard,” economist Saifedean Ammous argues at length that the United States federal government has been propagandizing the masses into choosing “cheap industrial substitutes” and “massively reducing (its) meat consumption” since at least 1916.

As Ammous wrote:

“…the ADA (American Dietetics Association) is responsible for formulating the dietary guidelines taught at most nutrition and medical schools worldwide, meaning it has for a century shaped the way nutritionists and doctors (mis)understand nutrition. The astonishing consequence is that the vast majority of people, nutritionists, and doctors today think that animal fat is harmful, while grains are healthy, necessary, and safe!”

In other words, even though a meat-centered diet is superior to a grain-centered one, the government and its quasi-private partners succeeded in persuading millions of people into opting for the latter.

Ammous raises the topic of dietary guidelines as just one example of how a fiat standard distorts an industry, but there’s another lesson in this story that Bitcoiners have to grapple with:

Even if your product is the best on the market, governments (and other entities) are capable of spreading narratives that persuade citizens to choose an inferior alternative.

If it happened with food, it could happen with money.

A CBDC Punch-Counterpunch

On July 10, 2023, Karin Strohecker published an article in Reuters titled, “Twenty-Four Central Banks Will Have Digital Currencies By 2030, Survey Shows.” Apparently, a couple dozen central banks have been making “great” progress in their development of central bank digital currencies (CBDCs). Strohecker wrote that these central banks have been “working on digital versions of their currencies for retail use to avoid leaving digital payments to the private sector (emphasis added) amid an accelerating decline of cash.”

This purported motivation behind CBDCs has been brewing for a while — in August 2022, the European Central Bank (ECB) released a report called “Towards The Holy Grail Of Cross-Border Payments.” In it, the authors compared the merits and demerits of various technological implementations of a cross-border payment solution that might be “immediate, cheap, universal and settled in a secure settlement medium.” Of the candidates they considered, they concluded that “Bitcoin is least credible” and that “the interlinking of domestic instant payment systems and future CBDCs, both with a competitive FX conversion layer” are the two most credible solutions.

While the ECB left out any remark about the risks that CBDCs pose to citizens’ privacy and sovereignty, River Financial responded with a report of its own. Spearheaded by River’s Sam Wouters, this report does explain the gaping hole in the ECB’s argument for CBDCs, as well as the technological barriers that Bitcoin ought to overcome if it’s going to be adopted worldwide.

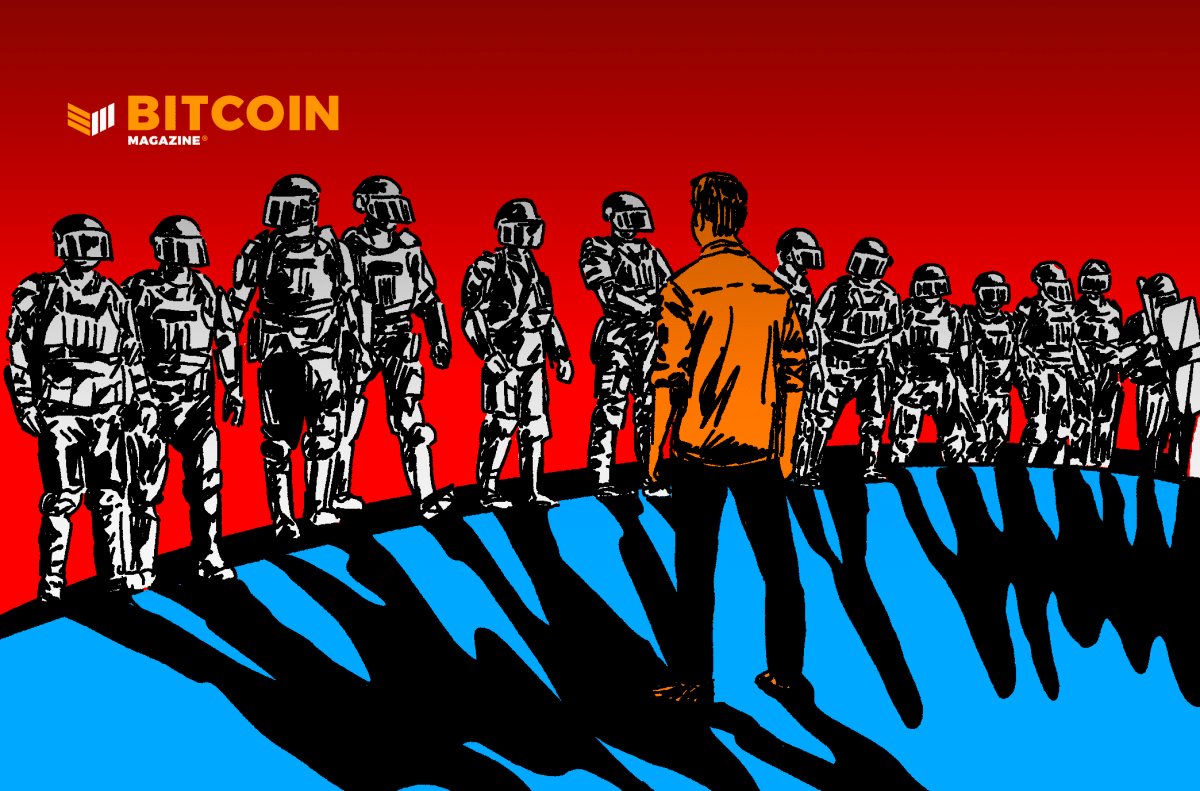

Readers can review the technical and quantitative arguments of both ECB and River Financial for themselves — my purpose in bringing up this punch-counterpunch is that the battle between freedom-money and tyranny-money is not one that we will win by default, and that it’s as much a battle for hearts and minds as it is for product superiority. Much like the propaganda campaign that persuaded people to switch from healthier diets to those that the government preferred, central banks are levying their best words, videos and other marketing techniques to convince people that CBDCs are superior to Bitcoin.

And, in the end, their victory is possible.

Understanding The Education Process

We know that Bitcoin solves humanity’s many monetary problems far better than CBDCs do. We recognize the havoc that rampant inflation wreaks on nations. We understand that lacking a store of value is the cause of so many anti-civilizational behaviors. But that’s not enough. If others don’t understand the fiat origins of these problems, they don’t stand a chance of appreciating Bitcoin as their solution. Whether or not central banks recognize the importance of this knowledge in the battle over the future of money, they’re certainly taking every opportunity they can to spread ideas that push Bitcoin to the outskirts and earn CBDCs widespread acceptability.

“Bitcoin bad, CBDCs good,” the people think. And that’s all central banks need, the inferiority of their product be damned.

As Wouters rightly pointed out in his report:

“Great strides have been made in education, but if Bitcoiners who are less experienced in education want to accelerate adoption, they would benefit from gaining a deeper understanding of the education process to take ownership of it and become more effective. This starts by understanding the gap between their perspective and knowledge and that of the recipient… (S)ome people inside the Bitcoin space are not aware enough of how difficult it is for the average person to go through this journey.”

As much as Wouters heroically explains the “how,” “what,” and “why” of the technological improvements that will help Bitcoin achieve widespread adoption, none of these holds a candle to people’s ideas about money. Even if Bitcoin eventually becomes as easy to use as credit cards or cash, the masses could still reject it in favor of CBDCs for purely-ideological reasons. Grain will have defeated meat once again.

This is no reason to despair. Bitcoin isn’t inevitable, no. But victory is possible, and its fate is largely determined on the ideological battlefield. The gap between our deepest explanation of monetary economics and most people’s views on the subject is vast. The same goes for the problems that fiat money continues to cause, the dangers of CBDCs, and how and why Bitcoin is a panacea for most of our money problems.

The educational effort before us is enormous, but, in the face of the enemy’s propaganda, necessary. And it’s thrilling — billions of people are about to learn about the greatest civilizational battle they hadn’t even known was occurring right under their noses.

Our war is an ideological one. Bitcoin doesn’t have to suffer the same fate as meat — and the industrial sludge that is CBDCs can perish in the sewers of history. We have persuading to do.

This is a guest post by Logan Chipkin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.