This is an opinion editorial by Steven Hay, a writer, former trader and art dealer.

The Ordinals controversy is still simmering and seems set to flare up again soon. Although Ordinals’ block space usage had been trending down since March 23, 2023, the release of notable collections and a burgeoning mania for BRC-20 tokens seems to have reversed that trend.

Should competition for block space between Ordinals, BRC-20 tokens and purely monetary transactions remain high, so will fees. And, should fees climb sufficiently high, the ghastly shades of the blocksize war may rise once more to torment all Bit-kind.

The Case Against Ordinals

Fees aren’t the only flashpoint. While Bitcoin has certainly had its share of negative headlines over the years, the protocol itself has thus far escaped the same level of recrimination. Exchange failures, drug sales, countless scams — these are all things people did with the tech, rather than any intrinsic fault of the tech itself. Not so with, say, Ethereum, where sketchy smart contracts are virtually part of the machine.

With Ordinals popularizing the integration of Bitcoin’s blockchain with all manner of infamous Ethereum innovations (such as NFTs, tokens and, perhaps soon, smart contracts), reputational risk to the Bitcoin protocol grows. How long until a token is issued directly on Bitcoin which passes the Howey Test and so falls afoul of the U.S. Securities and Exchange Commission?

Further in this regard, Ordinals also greatly lower the barrier to introducing illicit or classified content into Bitcoin’s blockchain.

As for the loss of user funds due to rug pulls, bugs, hacks and takedowns, all of these boxes have already been ticked under Ordinals. Most recently, Ordinals Finance pulled a $1 million rug, albeit on the Ethereum side of the ledger. Just prior to that, UniSat fumbled the launch of its BRC-20s marketplace, resulting in costly double-spend attacks and a lengthy market halt. Before that, several major marketplaces bowed to legal pressure from Yuga Labs and delisted ape-related collections.

Furthermore, all of these “hiccups” occurred against the background of a bug discovered within Ordinals’ all-important indexing system. Finally — and I hate to say this — further problems of this nature are anticipated. Consider that one of the largest marketplaces by users and volume, Ordinals Wallet as well as the significant Ordswap marketplace both keep keys in browser local storage, according to what I’ve heard on Discord, which runs contrary to recommended security practices (to say the least).

I believe the above paragraphs summarize the case against Ordinals from the perspective of many Bitcoin Maximalists — among whose ranks I myself numbered, at least until the Ordinals purity spiral went helter-skelter. And while these concerns have merit, there’s one particular complaint which I believe deserves to go unmentioned; that Ordinals are a scam.

When willing buyers and willing sellers exchange goods with informational symmetry, without any claims made as to future price appreciation, well, that’s the definition of honest business — and that’s the current situation within Ordinals marketplaces. Prove me wrong.

In Defense Of Ordinals

A point in favor of Ordinals is that it’s possible to prune their content from stored blockchain data. Pruning resolves the blockchain file size bloat issue, which is fairly trivial considering that I expect the bloat to be easily outpaced by the growth of affordable data storage. More importantly, pruning ensures that anyone running a full node can opt out of storing any illegal material (which, to be fair, existed on Bitcoin’s blockchain long before Ordinals).

In regards to the reputational and legislative risks to Bitcoin arising from Ordinals content stored on the blockchain, these can be mitigated — but not eliminated — by proper communication. The point must be hammered home (and not just for the sake of Ordinals) that Bitcoin’s uncensorable and permissionless structure has certain unavoidable drawbacks which, on balance, are vastly outweighed by its advantages.

On the technical front, it’s possible that post-traumatic stress from the blocksize war is leading some to view Ordinals as a big-blocker-style assault on Bitcoin’s base layer… but as an entirely optional Layer 2, Ordinals have far more in common with the Lightning Network than with Bcash and its ilk. Granted, content insertion into witness data is also occurring, but that process is moderated by fees…

Fees? Lightning? Let’s not jump ahead to the resolution of this Ordinals controversy!

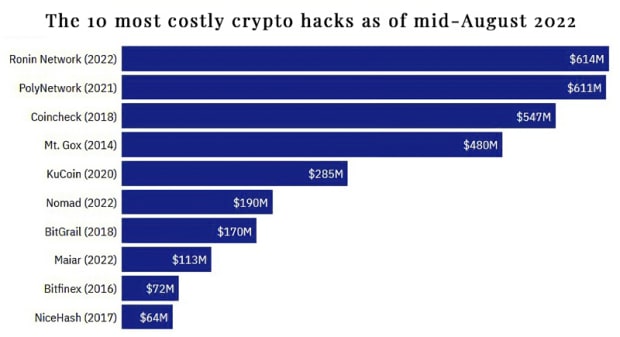

As for the loss of user funds to cyber bandits or technical gremlins, such losses are likely to remain limited due to the relatively small size of the Ordinals economy. As the estimated total value of all Ordinals collection at the time of this writing is currently around 1,628 BTC, worth some $45 million, nothing approaching the scale of the infamous fiascos that have plagued crypto is even possible at this stage:

So much for playing defense. The fact is that Ordinals are attracting new users, developers, artists and companies to the Bitcoin space. This will surely have multiple benefits beyond the immediate boost to the value and prestige of the entire ecosystem. Onboarding more users of all kinds is the surest path to accelerating hyperbitcoinization. And if Bitcoin succeeds, the world will be liberated from the death grip of central banking — but let’s put our ruby-quartz visor back on and refocus.

While most early Bitcoiners got on board due to technical curiosity or ideological motivation, later adoption waves were likely driven by economic factors. Many of these later entrants stuck around because they realized Bitcoin is a revolution disguised as a get-rich-quick scheme. While we await the next bull cycle, Ordinals are attracting a fresh set of users, composed largely of young creatives.

Should we really turn these hopefuls away, to wander in the shitcoin swamps?

The Solution

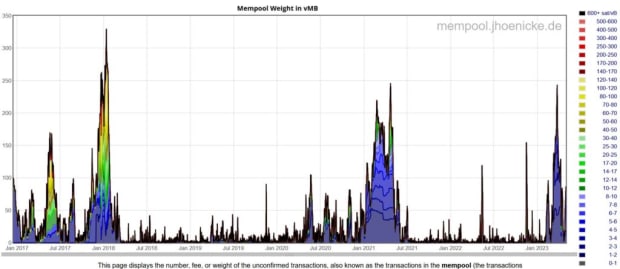

Ordinals have proven the strong demand for Bitcoin NFTs, tokens and smart contracts. Although such things have been tried on Bitcoin in the past, through whatever confluence of factors, the time is now demonstrably ripe for them. A quick glance at inscription count over time (currently over five million after about five months) is enough to confirm this. The associated impact on fees has been equally obvious:

Note that the two previous spikes, around the starts of 2018 and 2021, coincided with the resolution of massive bull markets. From January of this year, the markets have been fairly calm and the latest spike is attributable to Ordinals. This raises the question of how horrifically high fees will get if the current Ordinals volume persists into the climax of another bull cycle…

In my view, this is the only critical issue presented by Ordinals; a looming problem with the potential to outweigh the benefit of the adoption boost. With fees hitting the 600-plus sat per virtual byte (vB) nosebleed levels last seen in late 2017 and early 2018, Bitcoin might lose as many (or more) users to other chains as it gains from Ordinals.

The solution to high fees back in the day was the SegWit soft fork, which greatly reduced the size and fees of conforming transactions. SegWit also enabled the launch of the Lightning Network, a layer atop Bitcoin designed to process low-value transactions. One quirk of Bitcoin is its flat fee and data structure, whereby the cost and block space required to send $1 in BTC is equal to those for sending $1 billion in BTC. Offloading low-value transactions to Lightning frees up block space, resulting in lower bitcoin fees. In combination, these two upgrades ensured that when bitcoin pushed to its all-time high in 2021, fees remained reasonable.

So, why should the solution to high fees arising from Web3 stuff on Bitcoin be any different?

RGB, Taro, Stacks — these are all technologies to shunt Web3 transactions and data from the Bitcoin blockchain and onto Layer 2. While the approach seen in Ordinals and Stamps of writing content directly to the base layer offers unrivaled permanence and immutability, it’s also extremely costly. For example, an artist I spoke with recently told me that he spent $3,800 to inscribe a collection. Especially in these tough economic times, that’s a lot for a young creative to gamble in an unpredictable market!

Consider that, as of this writing, 200 of the collections tracked by OrdinalHub have seen zero all-time volume, as in no sales at all. This figure barely scratches the surface of market failures. Sorting the 1,000-plus collections on Best In Slot by inverse weekly sales volume reveals hundreds with zero sales. See for yourself how many low-value collections on Ordinals Wallet have had zero volume or sales over the last week. Pending a proper analysis, my intuition is that fewer than one in 100 inscriptions listed on a marketplace will turn a profit.

The novelty of Ordinals will fade, but the high costs will remain. Given that Layer 2 solutions don’t store data on the blockchain, their creation costs will be orders of magnitude lower. High-end collections, like Asprey Bugatti Eggs, may still inscribe to Ordinals as the perceived luxury and maximum-permanence option, but the vast majority of creators will opt for the inexpensive alternatives still linked to Bitcoin, even if indirectly.

Cost isn’t the only factor behind the inevitable migration of most users to Layer 2. The size constraints of Bitcoin blocks make bulky content (like high-resolution images or audio, complex code and all but the shortest video clips) unaffordable or even impossible to inscribe. With generative AI making it easy to create high-resolution image content — and soon audio and video content, too — how much longer will the average creator be content to pay a relative fortune to inscribe text and small, static images?

Base Layer To Layer 2

The way I see things playing out, Ordinals has proven the market demand for Bitcoin-based NFTs, tokens, DeFi, etc. — as unpalatable as some may find that demand. Regardless, the cost and relative slowness of these assets on the base layer should eventually drive most users to Layer 2 solutions, already nearing completion. The base layer will perhaps become the digital equivalent of the Louvre, housing only the most significant works under the tightest security. Layer 2 will host everything else.

Ordinal antagonists should take note. Twitter screeds denouncing inscribers as attackers for adding monkey JPEGs to the blockchain only incite hilarity and encourage defiance. A $100 or even a $25 inscription fee is a far more effective disincentive, already established and requiring no keyboard bashing. To defuse the looming threat of high fees, the proactive strategy would be to contribute or donate to the development of Layer 2 solutions.

This is a guest post by Steven Hay. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.