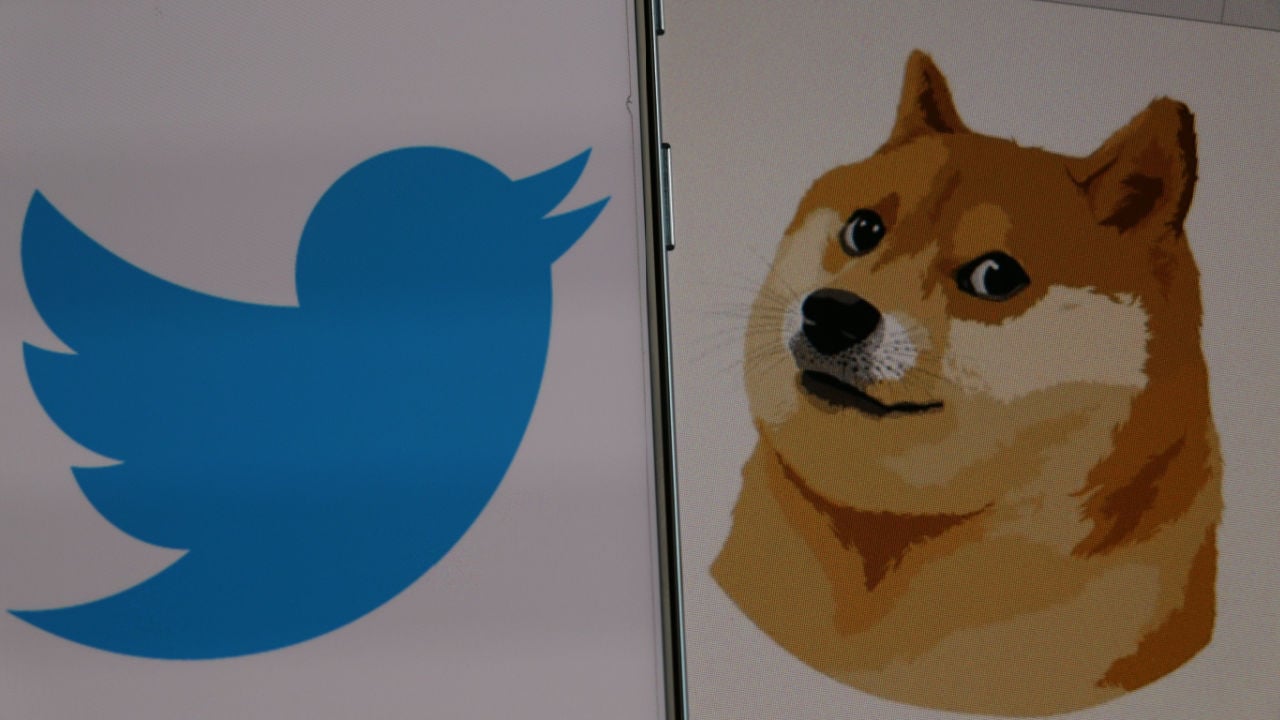

Shiba inu moved close to a five-month low on Friday, as meme coins reacted to news that Elon Musk has found a new Twitter CEO. Musk tweeted, “Excited to announce that I’ve hired a new CEO for X/Twitter. She will be starting in ~6 weeks.” Dogecoin neared a two-month low today.

Shiba Inu (SHIB)

Shiba inu (SHIB) neared a five-month low on Friday, as markets reacted to the news that Elon Musk will be stepping down as CEO.

Musk, who acquired the social media company last year, has been at the helm since the takeover, but has now found a long-term replacement.

Following a high of $0.000008746 on Thursday, SHIB/USD dropped to a bottom of $0.000008549 earlier in the day.

As a result of this sell-off, shiba inu moved close to Monday’s low at $0.00000835, which was the weakest point the meme coin has hit since January.

Looking at the chart, this latest move occurred as the relative strength index (RSI) moved deep into oversold territory, with a current reading at 23.02.

This does give hope to longer-term bulls however, that a reversal could be on the cards.

Dogecoin (DOGE)

Dogecoin (DOGE) also moved lower in today’s session, as the meme coin neared a multi-month low of its own.

DOGE/USD fell to an intraday low of $0.06957 earlier on Friday, hours after trading at a peak of $0.07268.

Similar to SHIB, today’s decline almost led to dogecoin recapturing a low of $0.0692, which was its weakest level since March.

DOGE has since bounced back from this earlier low, after bulls rejected a full breakout of a support point of $0.07000.

As of writing, the price is now at $0.07127, which seems to have occurred as traders moved to buy the dip.

Should today’s low be the hard floor, there will likely be a stronger rebound in the coming days.

Register your email here to get weekly price analysis updates sent to your inbox:

Could DOGE climb towards $0.08000 next week? Let us know your thoughts in the comments.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Peace-loving / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.