This article is featured in Bitcoin Magazine’s “The Primary Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this article.

“Economics I think is sort of like accounting — you know, it doesn’t immediately have any morals. You could go into welfare economics, you try to think of some human values or you go into variations.” – John F. Nash Jr., The University of Scranton, November, 2011.

This quotation from John Forbes Nash Jr. is taken from a lecture Nash gave on “Ideal Money and the Motivations of Savings and Thrift”, some 61 years after the publication of his first game theory paper simply named “The Bargaining Problem” (1950).

“The Bargaining Problem” is significant because it is believed to be one of the first examples where an axiomatic approach is introduced into the social sciences. Nash introduces “The Bargaining Problem” as a new treatment of a classical economic problem — regarding it as a nonzero-sum, two-person game, where a few general assumptions and “certain idealizations” are made so that values are found for the game.

The genealogy from “The Bargaining Problem” to Nash’s later works on Ideal Money is established, where in “The Bargaining Problem” Nash remarks upon the utility of money:

“When the bargainers have a common medium of exchange the problem may take on an especially simple form. In many cases the money equivalent of a good will serve as a satisfactory approximate utility function.” John F. Nash Jr., The Bargaining Problem (1950).

Nash’s bargaining proposal is essentially asking about the fairest way to split $1 between participants in a financial transaction or contract, where each side has a range of interests and preferences and where there must be agreement, or else both sides will get nothing. The axioms which are introduced for a Nash bargain go on to define a unique solution.

Nash Equilibrium versus Nash Bargaining

In The Essential John Nash (2007), Harold Kuhn describes Nash’s subsequent “Non-Cooperative Games” (1950) paper, and what later became known as Nash equilibria, as a “clumsy, if totally original, application of the Brouwer fixed point theorem”. Yet it was Nash’s equilibrium idea which bestowed him a public profile through a Nobel prize in the economic sciences. Nash’s life was later dramatized in the Hollywood film A Beautiful Mind.

In “Non-Cooperative Games”, Nash’s theory is based on the “absence of coalitions, in that it is assumed each participant acts independently, without collaboration or communication with any of the others”. In Adam Curtis’s television documentary The Trap (2007), Nash describes his equilibria as social adjustment:

“…this equilibrium which is used, is that what I do is perfectly adjusted in relation to what you’re doing, and what you’re doing or what any other person is doing is perfectly adjusted to what I am doing or what all other people are doing. They are seeking separate optimisations, just like poker players.” John F. Nash Jr., The Trap (2007, Adam Curtis), F*ck You, Buddy.

The difference between Nash equilibrium and Nash bargaining is that axiomatic bargaining (or reaching a Nash bargain) assumes no equilibrium. Instead, it states the desired properties of a solution. Nash bargaining is regarded as cooperative game theory because of its nonzero-sum characteristic and the existence of contracts. Nash extended the axiomatic treatment of The Bargaining Problem in “Two-Person Cooperative Games” (1953), introducing a threat approach in which there is an umpire to enforce contracts — in the process discounting “strategies” as not containing special qualities and rather focusing on formal representation of a determined game.

Ideal Money and Asymptotically Ideal Money

Just before the turn of the century, John Nash starts writing and lecturing on an evolving thesis called Ideal Money. It assumed different iterations over the years, but Nash defined it as money intrinsically free of inflation or inflationary decadence. Nash isn’t so much critical of Keynes the economist or person, but of the psychology of what’s become known as Keynesianism; Nash regarded it a Machiavellian scheme of continual inflation and currency devaluation. Nash believed if central banks are to target inflation, they should target a zero rate for “what is called inflation”:

“It is only really respectable that there should not be an arbitrary or capricious pattern of inflation, but how should a proper and desirable form of money value stability be defined?” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2010.

In “Ideal Money”, Nash returns to the axiomatic approach he first establishes in his inchoate game theory. Ideal Money therefore becomes critical of Keynesian macroeconomics:

“So I feel that the macroeconomics of the Keynesians is comparable to a scientific study of a mathematical area which is carried out with an insufficient set of axioms.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

Nash defines the missing axiom:

“The missing axiom is simply an accepted axiom that the money being put into circulation by the central authorities should be so handled as to maintain, over long terms of time, a stable value.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

In 2002, in the Southern Journal version of Ideal Money, Nash realizes an ideal money can’t be completely free of inflation (or too “good”), as it will have problems circulating and could be exploited by parties who wish to safely deposit a store of wealth. Nash then introduces a steady and constant rate of inflation (or asymptote) which could be added to lending and borrowing contracts.

Indeed, Nash describes the purpose of Ideal Money in a cooperative game and microeconomic context:

“A concept that we thought of later than at the time of developing our first ideas about Ideal Money is that of the importance of the comparative quality of the money used in an economic society to the possible precision, as an indicator of quality, of the contracts for performances of future contractual obligations.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

Bitcoin as an Axiomatic Design

If Nash’s view of economics was that it lacks any immediate morals — and that values, assumptions, axioms, variations, or idealizations can be introduced to determine a nonzero-sum or determined game which provides welfare for all participants — then it is worth considering if these axioms are present in the Bitcoin system, given that Nash, together with Satoshi, were both critical of the arbitrary (or undetermined) nature of centrally managed currencies.

- Pareto Efficiency

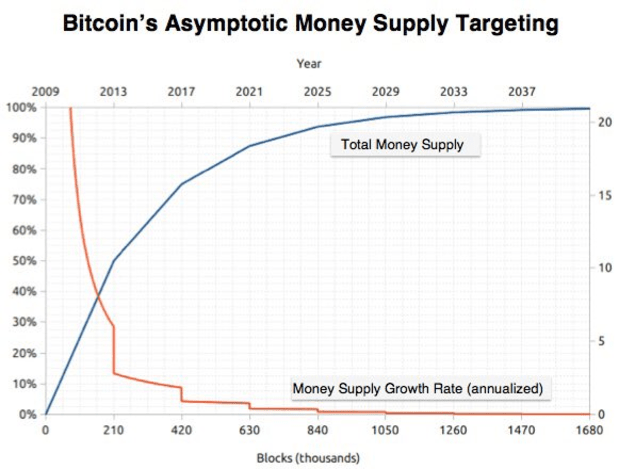

The presence of Pareto efficiency is perhaps the most demonstrative Nash bargaining axiom (see illustration) in Bitcoin with respect to the cumulative supply density and distribution: The majority of coins are mined relatively early in the Bitcoin lifespan (loosely following the Pareto 80/20 power law).

- Scale Invariance

The scale invariance is present through the difficulty adjustment mechanism which keeps bitcoin supply “steady and constant” (a phrase both Nash and Satoshi use). No matter how popular or unpopular bitcoin becomes to mine, the scale invariance should mean players can form realistic expectations on the value of bitcoin, and that their underlying preferences shouldn’t change regarding this. The internal divisibility of bitcoin also means the value a coin is expressed in (whether the U.S. dollar or other currency) shouldn’t matter over shorter or immediate time frames — just as room temperature can be expressed as Celsius or Fahrenheit without affecting the actual temperature. These differences should become clear only over the longer term or in intertemporal transactions.

The adjustment mechanism also keeps total bitcoin supply at just under 21 million, due to a side effect of the system data structure, and therefore introduces the asymptote.

- Symmetry

Nash’s symmetry axiom is present in the pseudonymity and decentralization of the Bitcoin network, which provides for equality of bargaining skill (a phrase Nash introduces in “The Bargaining Problem”) through not having to prove first-person identity in participating in the core or primary network. It means there isn’t a centralized or trusted principal responsible for minting the coins, a “grand pardoner” in Nash’s words. In relation to Nash bargaining, two players should get the same amount if they have the same utility function, and are therefore indistinguishable. Alvin Roth (1977) summarizes this as the label of players not mattering: “If switching the labels of players leaves the bargaining problem unchanged, then it should leave the solution unchanged.”

- Independence of Irrelevant Alternatives (IIA)

Finally, there is Nash’s most controversial bargaining axiom: the Independence of Irrelevant Alternatives. In simple terms, this means adding a third (or non-winning candidate) to an election between two players shouldn’t alter the outcome to the election (third parties become irrelevant). If peer-to-peer is referring to a two-player game, with the Bitcoin software acting as a third-party arbitrator or umpire to “the game” with the software designed to a set of values or axioms, then it’s possible that IIA is present in Bitcoin’s proof-of-work. This speaks to a social group preference context: The proof-of-work says it solves the problem of the determination of representation in majority decision-making, and that Nash’s axiomatic bargaining (in both “The Bargaining Problem” and “Two-Person Cooperative Games”) explicitly addresses formal representation in determinative games.

Characteristics and Benefits of Cooperation

Generally speaking, there are believed to be three conditions required for a cooperative game:

- Reduced participants, as there is less room for verbal complications, i.e., two players.

- Contracts, where participants are able to agree on a rational joint plan of action, enforceable by an external authority such as a court.

- Participants are able to communicate and collaborate on the basis of trusted information and have full access to the structure of the game (such as the Bitcoin blockchain).

In respect of a nonzero sum game and the money preference, John Nash reflects on how money can facilitate transferable utility by way of “lubrication”, and makes this observation:

“In Game Theory there is generally the concept of ‘pay-offs’, if the game is not simply a game of win or lose (or win, lose, or draw). The game may be concerned with actions all to be taken like at the same time so that the utility measure for defining the payoffs could be taken to be any practical currency with good divisibility and measurability properties at the relevant instant of time.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011.

The benefits of cooperation reduce the need for mediation or dispute resolution as contracts and agreements become more trustworthy; less border friction in trading; a nonzero-sum outcome (win-win bargaining or welfare economics); more intuitive, informal decision-making; and the possibility for coalition formation which John Nash ultimately defines as a world empire context. The latter makes resolutions to difficult problems like net zero (or any other problem requiring multilateral coordination) more realistic. Nash likens his Ideal Money proposal to old-fashioned sovereigns:

“Any version of ideal money (money intrinsically not subject to inflation) would be necessarily comparable to classical “Sovereigns” or “Seigneurs” who have provided practical media for use in traders’ exchanges.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011.

Nash also reflects in 2011 on a “game” of contract signatures, as if Ideal Money is the contract:

“It is as if there is another player in the game of the contract signers and this player is the Sovereign who provides the medium of currency in terms of which the contract is to be expressed.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011

Concluding Remarks

It’s plausible to describe the Bitcoin system as a cooperative game in a non-cooperative setting, and while it may be that the axioms present in Bitcoin are not limited to just those required for a Nash bargain, it would appear there are ingredients in the system design that give Bitcoin a deterministic characteristic. At the very least, they contain certain morals as Nash remarked as desirable in his Scranton lecture.

Finally, John Nash first conceived his bargaining solution in 1950. It is perhaps fitting therefore he provides a simpler context to framing the question of money as that of “honesty” in one of his final lectures on the subject delivered to the Oxford Union shortly before his death in 2015.

References

A Beautiful Mind – S Nasar

“The Bargaining Problem” – J Nash

“Non-Cooperative Games” – J Nash

“Two-Person Cooperative Games” – J Nash

The Essential John Nash – H Kuhn & S Nasar

Nash Bargaining Solution – Game Theory Tuesdays – P Talwalkar

This article is featured in Bitcoin Magazine’s “The Primary Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this article.