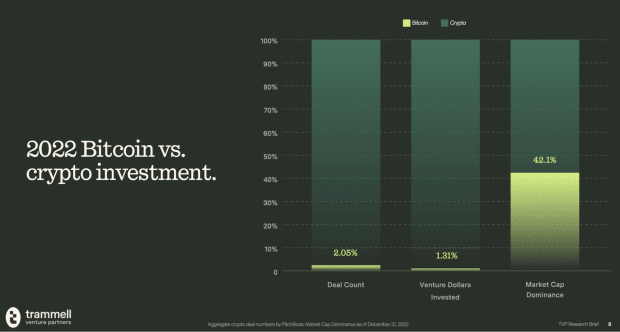

The report examines the growth of the industry and highlights the discrepancy between bitcoin’s dominance and the level of investment bitcoin startups receive.

Trammell Venture Partners (TVP), an Austin-based venture capital firm focused on Bitcoin, has released the venture industry’s first Bitcoin-native startup ecosystem research. The study found that despite the market drawdown in the broader crypto market in 2022, Bitcoin has emerged as a growth category in venture capital, with a 52.9% increase in deal activity year-over-year. The report also highlighted the misallocation of capital for Bitcoin startups and the gap in institutional venture capital for founders focused on the Bitcoin tech stack and ecosystem.

Christopher Calicott, TVP’s managing director and founding partner, commented in a press release sent to Bitcoin Magazine that “Bitcoin — the first, best, and only truly decentralized ‘crypto’ asset — is becoming a platform at an accelerating pace. Despite its consistent market capitalization dominance, venture capital into Bitcoin startups in 2022 only represented about 1.3% of invested capital sector wide. TVP intends to change that.”

According to the press release, TVP launched the venture industry’s first dedicated Bitcoin-native ecosystem-focused fund series in 2021 with a goal of institutionalizing venture investment for this emerging growth category within the wider crypto venture capital industry. The release of the Emerging Bitcoin-Native Venture Capital Research Brief marks a new phase of TVP’s plans to augment the available research for Bitcoin startups.

Technical development of Bitcoin Core has proceeded carefully, avoiding inducing risk associated with fast changes, yet the growth of the Bitcoin startup category has begun to accelerate in the last two years, the press release states. In addition, technology enablements such as SegWit (2017) and Taproot (2021) activations gave rise to the Lightning Network and other areas for entrepreneurial exploration and development.

TVP’s Emerging Bitcoin-Native Venture Capital Research Brief is available for download on the company’s website.