Sales of Donald Trump’s digital collectibles surged following the news of his indictment in New York on Thursday. Meanwhile, a report revealed that the market for non-fungible tokens (NFTs) has seen its strongest quarter since early last year, reaching a trading volume of $4.7 billion, despite a weaker March.

Trump NFTs Spike as Former President Gets Indicted

The Official Trump Digital Trading Cards have registered a surge in sales, according to data from the NFT market Opensea, following the news that the 45th United States President has become America’s first head of state, former or incumbent, to face criminal charges.

The sealed indictment by a Manhattan grand jury has over 30 counts related to business fraud, media reports unveiled. It comes after an investigation into an alleged hush money payment scheme involving adult film star Stormy Daniels which dates back to the 2016 presidential election.

The NFT collection was announced by Trump on social media in December when the first badge was sold within hours of launch. The thousands of tokenized cards depict him as just about anything masculine, up to a Superman character.

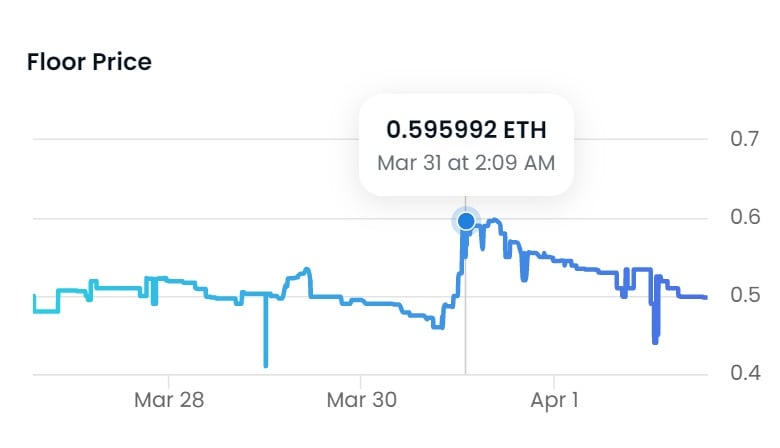

After the indictment, the sales increased well over 400% in a day, reaching a volume of above 90 ETH on Thursday (around $166,000 at the time of writing) and exceeding a floor price of 0.59 ETH on Friday, March 31, the Opensea stats show. The number of owners now nears 14,000 but prices have since returned to more average levels.

NFT Trading Volume Reaches $4.7 Billion in Q1, 2023

According to a report by the global decentralized apps store Dappradar, NFTs have had a generally strong first quarter this year, despite a significant slide in sales in March. In Q1 of 2023, as a whole, the trading volume expanded by more than 137%, to $4.7 billion, which is the highest increase since the second quarter of 2022.

Dappradar also noted that Q1 was the first quarter when Opensea did not dominate the market for non-fungible tokens. “The NFT market is rapidly evolving, with the emergence of new players and changing dynamics,” the authors highlighted.

“We haven’t registered such a percentage since February 2021,” the platform pointed out in a blog post titled “NFT Marketplace War Doubles Trading Volume in First Quarter,” a reference to the competition between Opensea and Blur. The latter had over 57% of the market in the first three months of the year, more than 70% in March.

Do you think the NFT market will see stable growth in the coming months? Share your thoughts on the subjects and your predictions in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Koshiro K / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.