As a venture capitalist, I maintain a “token agnostic” stance. Because we invest at the early stages of a new technology’s development, we invest in equity rather than tokens, only receiving tokens on a pro-rata basis. We firmly believe that for a token to be valid, it should serve a crucial role; in essence, removing the token should disrupt the core value proposition and underlying architecture. Merely having tokens for their sake, or avoiding them without reason, raises immediate red flags. In much of Web3, there’s an overflow of tokens made just to have a token. Projects which may have otherwise succeeded but fail due to their token’s economic unsustainability and lead to significant financial losses for investors. Contrastingly, within the Bitcoin community, you’ll find developers wasting uncountable hours on unsolvable technology problems in what amounts to solutions I call “tokenless tokens” – an approach I liken to “attempting sex without intercourse.” Both approaches seem irrational.

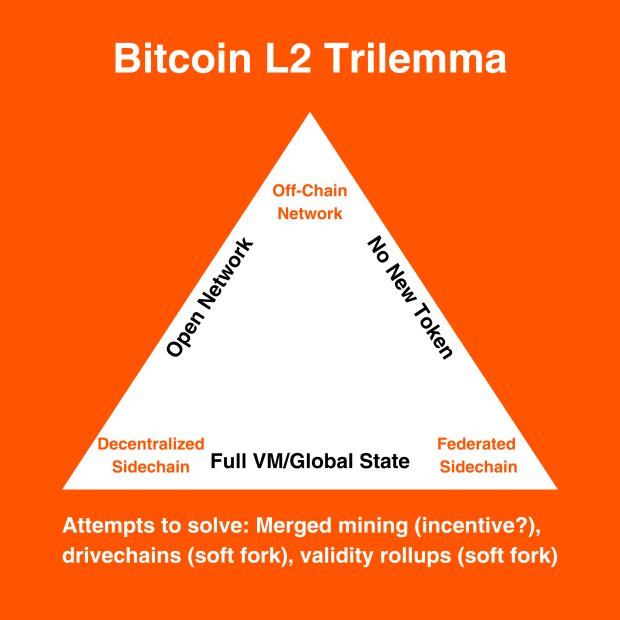

Now, let’s delve into the three facets of this trilemma:

1. Off-Chain Networks

These aren’t blockchains but networks that save data off-chain (stored by users). There isn’t a universal public ledger here, making data and smart contracts less accessible and interactive. Thus, you miss out on the comprehensive functionalities offered by smart contract blockchains like Ethereum or Solana. It also requires users to run their own nodes or infrastructure in order to be fully decentralized, resulting in a significant user experience barrier for adoption. That said, this approach affords scalability and privacy benefits far beyond what blockchain technology will ever be capable of, making it optimal for application-specific use cases, notably scaling payments.

2. Decentralized Sidechains

e.g., Stacks, Interlay, Layer-0 solutions, etc.

Decentralized Sidechains enable anyone to participate in consensus (i.e. mining blocks), as they supplement their security budget with a new token issued by the protocol. This results in a competitive marketplace of miners spending resources vying to earn the blockchain’s native token, subsequently utilized by users to cover gas fees when executing smart contracts. The anticipation is that increased usage and network effect will bolster the token’s demand and make it economically sustainable. However, introducing an extra token could complicate the user experience. Moreover, the “Laser-Eye” Bitcoin maximalists will attack these efforts and call them a scam for their perceived competition with BTC as an asset; making a developer’s life more stressful. On the upside, possessing a token can foster community building and facilitate capital raising to fund substantial research and development efforts.

3. Federated Sidechains

In this scenario, absent a token, miners (or validators) are compensated solely by the company behind the development effort, or by blockchain user fees, which often amounts to negligible sums for years until significant uptake occurs. This compensation is needed because in Proof-of-Work-style consensus models, mining costs money; in Proof-of-Stake, there’s the risk of capital being slashed. Even Bitcoin and Ethereum, with over 100M users each, predominantly fund their security budget through a token reward subsidy. To address this, a federated sidechain doesn’t open mining to everyone. Take Liquid, for example; it has formed a group of 15 crypto businesses, including exchanges, trading desks, and infrastructure providers. While this approach can work well, it requires trust in the selected entities. To become more decentralized over time, the age-old dilemma arises: how to draw in ample users and fees while functioning within a trusted group? Efforts are underway to devise hardware solutions to automate and potentially democratize membership, but trust now shifts to the hardware being utilized. So what are the advantages of federated sidechains? A more streamlined user experience, as these sidechains utilize a form of pegged BTC for network fees. Avoiding a new token also reduces the likelihood of facing opposition from the “Laser-Eye” Bitcoiner camp. Although it’s yet to be seen whether this group of Bitcoiners will actually participate in the Web3 use cases these sidechains enable.

Additional Insights: Mining vs. Bridging

It’s pivotal to recognize the distinction between RSK and Liquid. The former employs Merged Mining and has impressively garnered 64% of BTC’s hashrate as of February 2022. However, RSK has a federation and hardware-centric approach for their bridge. In contrast to this, token-based sidechains are building decentralized bridges which use their native token as collateral. Examples of this include sBTC, which Stacks is advancing, and alternatives by Interlay and several Layer-0 sidechains. By leveraging the native token as collateral, this design uses the chain’s native token as collateral, providing an incentive model to sustain an open-membership bridging protocol for the BTC asset. BitVM, newly introduced this month through a white paper, could present a solution to make federated bridges more trust-minimized and eliminate the need for hardware-based solutions. I’m closely watching its progress over the coming months.

Three Potential Solutions to Solve the Trilemma

Numerous prospective solutions necessitate a Bitcoin soft fork, which could take a considerable time to gain traction. Drivechains serve as a recent controversial example. Initially proposed in 2017, it’s now having its moment. Validity Rollups (or zk Rollups) hold promise and have garnered more positive feedback from several Bitcoin Core developers. Yet, effective implementation remains a challenge and could be a distant reality. Merged Mining is intriguing, especially with RSK demonstrating significant adoption from Bitcoin Miners, even without compelling incentives. However, the absence of a token still means reliance on a trusted bridge or advanced hardware configurations that await market validation. BitVM might revolutionize federated bridges in tandem with merged mining in the coming years, potentially resolving the decentralization dilemma.

The Question of EVM (A Topic for Another Day)

It’s worth highlighting that many sidechains opt for EVM (the Ethereum Virtual Machine), with RSK, Botanix, and numerous Layer-Zero solutions taking this approach. This decision fast-tracks market entry and ensures compatibility with exchanges and EVM-centric blockchain infrastructure. Conversely, Stacks and Starkware (zk Rollup) have devised their own virtual machines, aiming to be an improvement over EVM in specific areas, such as decidability and zk compatibility. This dual-edged sword means they might lose the network effect but may provide developers a platform to craft superior applications and distinguish themselves from market-leading applications on Ethereum.

Abolish All Tokens

For most builders, the decision about a token should be rooted in practical concerns. Even on Ethereum, where Layer-2 Validity Rollup solutions don’t require a token because of their smart contract support on Layer 1, leading projects like Optimism and Arbitrum have tokens. They leverage these tokens to strengthen community ties and finance development. This market-based evidence further complicates navigating the token vs. no token question. BASE, a Layer-2 Ethereum initiative by Coinbase, has recently garnered significant traction without having its own token. However, the company has indicated that introducing a token in the future remains an option.

Drawing from my past experience as a corporate innovation executive and an entrepreneur, I liken the token vs. no token debate to the startup equity vs. corporate equity conundrum. In my book, “The Lean Enterprise” (2014), I highlighted numerous instances where internal innovation attempts failed due to lack of incentives proportional to the high risks and extensive R&D these projects demanded. Even Google, known for its innovation-focused corporate culture, witnessed its employees forgo hefty stock options to venture out on their own, leading to the birth of giants like Twitter, Instagram, Niantic (of Pokemon Go fame), Pinterest, and more. This resulted in a potential market cap loss worth over a hundred billion dollars.

Layer 2 projects carry immense risks, with a majority bound to fail. The funds required for their development are significant. New Bitcoin cannot be created to fund a new blockchain’s security budget or developer community. Despite offering fewer security benefits than Validity Rollup solutions like Optimism, Arbitrum, and BASE; Polygon, an Ethereum sidechain, still dominates in terms of market cap and developer engagement among all Ethereum scaling solutions. It’s now shifting towards a zk-based strategy. Hence, even if a zk-rollup method doesn’t inherently demand a token, possessing a native token for a blockchain (as opposed to an application) might offer a competitive edge. As with all things related to business, there are no clear cut answers.

Final Thoughts

The Bitcoin L2 space is captivating, with the race intensifying as protocols like Ordinals, BRC-20, and Runes attract more Web3 developers to build on Bitcoin. As Web3 investors, our focus remains on applications and infrastructure, steering clear of token trading. Presently, our interests lie in Off-Chain Networks with distinctive application-specific advantages and Decentralized Sidechains, primarily due to their open membership consensus model, community building, and capital acquisition benefits. We’re also bullish on Merged Mining, if BitVM succeeds at introducing a more trust-minimized approach for federated bridging. Importantly, both the collateral-driven bridges like sBTC and the BitVM method are still in developmental phases. BitVM was just announced via white paper this month and has garnered significant developer interest, while sBTC has been under development for over a year with substantial resources invested in the effort. Ultimately, alongside investing in Bitcoin L1 applications and infrastructure, the Bitcoin Frontier Fund aims to strategically venture into all three trilemma corners, investing in the most promising efforts by outstanding teams.

This is a guest post by Trevor Owens. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.