In cryptocurrency trading, a “buy wall” is a massive buy order, or multiple buy orders, around a particular price level. Conversely, a “sell wall” is a significant accumulation of sell orders at a given price level.

Before understanding how buy and sell walls work, it is important to know what an order book and its market depth are.

What is an order book in crypto trading?

An “order book” is an index listing buy and sell orders for a specific cryptocurrency based on price levels. A trade is executed when the orders on either side meet at a certain price level, establishing the cryptocurrency’s price as supply meets demand.

Nonetheless, these orders don’t get executed randomly — rather, the market fulfills them in the order of their sequence.

For example, two open orders are created when Peter Griffin attempts to sell 1 Bitcoin (BTC) for $25,000 and Cleveland Brown places an order to buy 1 BTC at $24,000. Suppose Glenn Quagmire joins in and tries to sell 1 BTC for $26,000. As a result, there are three unfulfilled, open orders.

But when a new buyer, Joe Swanson, enters the market and tries to buy 1 BTC for $26,000, he does not get Quagmire’s coin. Instead, he receives Griffin’s BTC for $25,000, and the Bitcoin spot price becomes $25,000.

Meanwhile, Brown’s and Quagmire’s orders will remain open.

What is market depth?

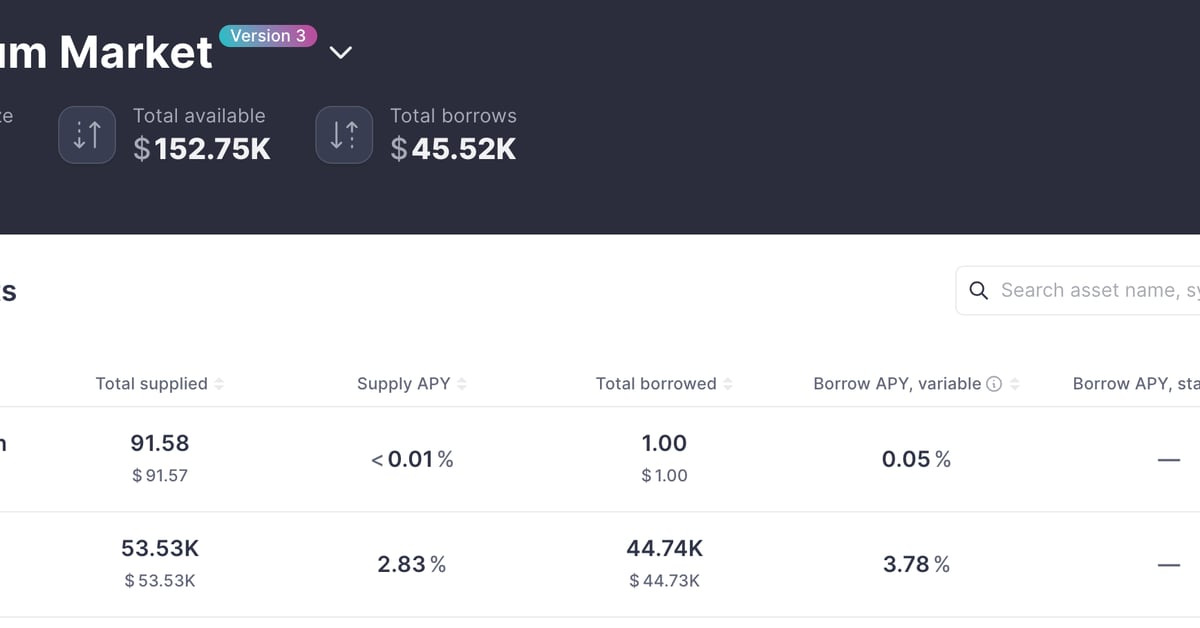

The open orders are packed together as buy and sell orders and pitted against one another on a market depth chart.

The X-axis on the graph represents the bid (buy orders in green) and the ask (sell orders in red) price, while the Y-axis represents the cumulative market volume.

Identifying buy and sell walls

A large spike sloping upward on the market depth chart’s either side is called a “wall.” These walls appear as deeper vertical lines resembling the side angle of a staircase, as seen in the example above.

A buy wall is formed when the number of buy orders massively exceeds the sell orders at a given price, thus illustrating greater demand for the cryptocurrency versus its supply. As a result, traders see the levels where buy walls appear as areas of support for a potential bounce.

Similarly, a sell wall is created when the number of sell orders surpasses the buy orders, showing weaker demand versus supply at a certain price level.

Related: How to trade bull and bear flag patterns?

A big buy wall against a drastically smaller sell wall on the market depth chart suggests strong demand and that the path of least resistance is currently to the upside, and vice versa.

Ultimately, viewing the order book as “walls” makes it easier for traders to spot potential areas for price rebounds and rejections.

As a note of caution, buy and sell walls should not be solely relied on to predict price direction. Orders can be pulled or introduced anytime, with market dynamics always in flux.

Moreover, “whale” traders can use their large capital to create or remove large walls of orders as a way to manipulate the market to their advantage.

For more tips about spotting and avoiding potential market manipulation, check out Cointelegraph’s previous coverage.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.